Analysing Financial Institutions: The CAMELS Framework!

DSIJ Intelligence-6 / 19 Sep 2025/ Categories: General, Knowledge, Trending

Analysing financial institutions requires a distinct approach, and CAMELS offers a structured, comprehensive lens.

Understanding CAMELS

Financial institutions like banks and NBFCs operate very differently from manufacturing or service companies. Their business models rely on financial intermediation—borrowing at lower rates and lending at higher rates—making their risk profile unique.

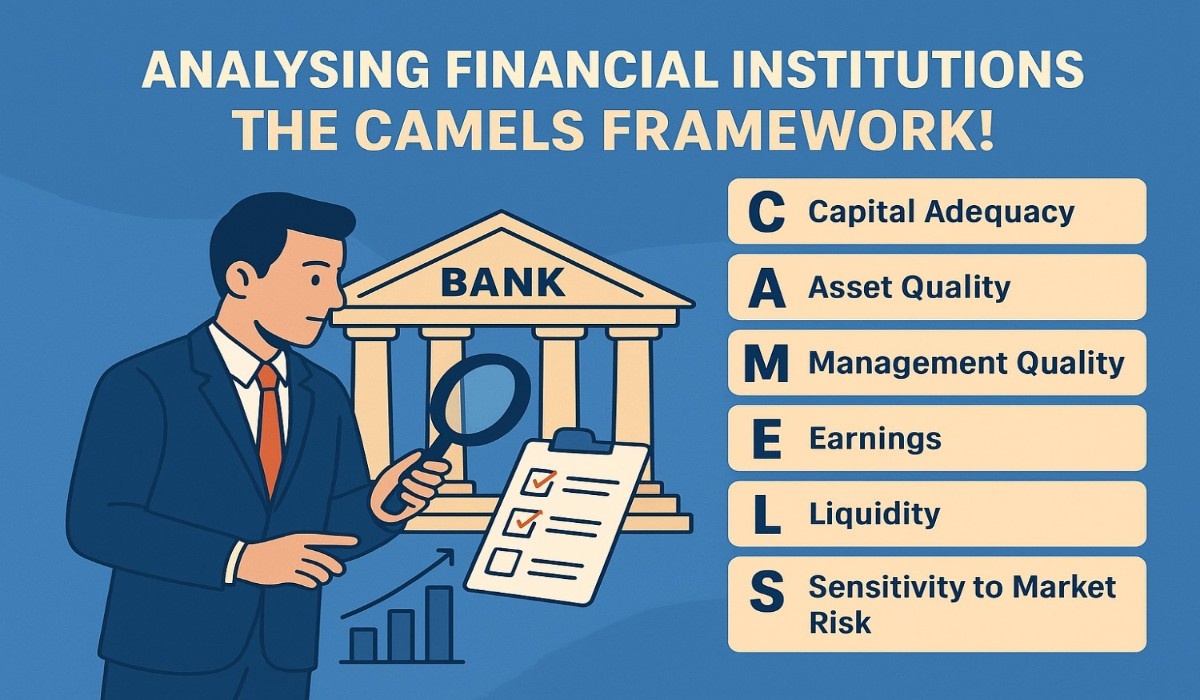

The CAMELS framework is a globally accepted system used by regulators and analysts to assess the safety, stability, and performance of financial institutions. It evaluates six crucial dimensions:

- C – Capital Adequacy: Measures the financial cushion against potential losses. Ratios like CRAR (Capital to Risk-Weighted Assets Ratio) and Tier-1 capital are key here.

- A – Asset Quality: Examines the quality of loans and investments. High Gross and Net NPAs signal poor asset quality and higher credit risk.

- M – Management Quality: Evaluates governance, risk culture, strategy execution, and compliance track record. Though qualitative, consistent growth with controlled risk reflects strong management.

- E – Earnings: Focuses on profitability metrics like ROA, ROE, Net Interest Margin (NIM) and cost-to-income ratio to assess sustainable earnings power.

- L – Liquidity: Measures ability to meet short-term obligations. Liquidity Coverage Ratio (LCR) and maturity profile of liabilities are key indicators.

- S – Sensitivity to Market Risk: Analyses exposure to interest rate, currency, and market fluctuations. Duration gaps and stress test results are useful here.

How to Use CAMELS for Analysis

To apply CAMELS, start with quantitative indicators from annual reports, Basel disclosures, and regulatory filings. Compare these metrics to peer averages and regulatory thresholds.

- A bank with high capital adequacy, improving asset quality, and stable earnings signals low credit risk.

- Declining NIMs, rising NPAs, or poor LCR indicate brewing stress.

- Management quality can be inferred from historical consistency, transparency in disclosures, and reputation with regulators.

Combining all six pillars gives a holistic risk-adjusted view of a financial institution’s health which ia something traditional profitability ratios alone cannot reveal.

Why CAMELS Works

CAMELS is effective because it integrates both risk and performance dimensions. Financial institutions can appear profitable in the short term while hiding credit or liquidity risks. CAMELS uncovers these vulnerabilities by:

- Forcing assessment of balance sheet strength, not just earnings

- Tracking early warning signals like rising NPAs or falling capital buffers

- Incorporating qualitative oversight on governance and market risk

Conclusion

Analysing financial institutions requires a distinct approach, and CAMELS offers a structured, comprehensive lens. It aligns with how regulators evaluate banks, making it highly reliable for investors too. By blending capital strength, asset quality, earnings power, and risk sensitivity, CAMELS helps identify resilient financial institutions capable of sustaining long-term growth.