Understanding Reflexivity Theory in Markets!

DSIJ Intelligence-6 / 19 Nov 2025/ Categories: Knowledge, Trending

Reflexivity Theory shows that markets are not driven solely by fundamentals, but also by beliefs, emotions, and behaviour.

What Is Reflexivity Theory?

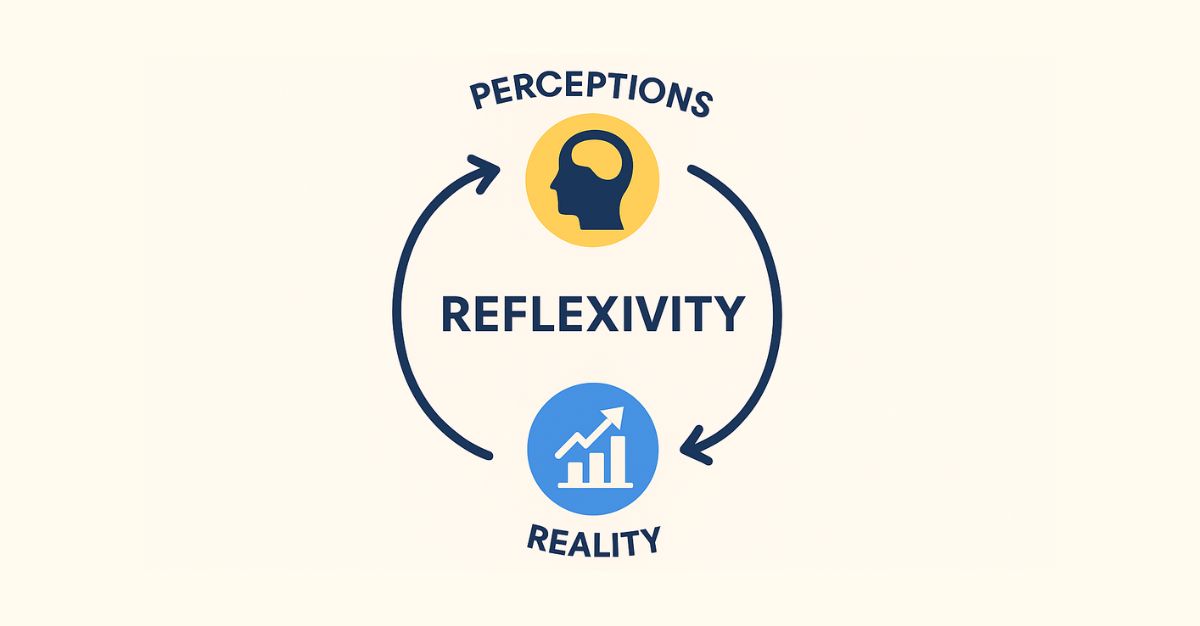

At its core, Reflexivity Theory states that markets are driven by a feedback loop between investor perceptions and market realities. According to this idea, what investors believe about the economy or an asset can influence their decisions—and those decisions can directly impact the outcome, making their beliefs come true.

In traditional economics, markets are assumed to be efficient and self-correcting: prices reflect fundamentals, and deviations are temporary. Soros argued this is not always true. Instead, markets often swing between optimism and pessimism, creating trends that reinforce themselves.

In simple terms:

Perceptions influence actions → actions influence fundamentals → fundamentals reinforce perceptions.

This loop is why markets can overshoot on both the upside and downside.

Who Introduced the Reflexivity Theory?

George Soros, one of the world’s most famous hedge fund managers, introduced Reflexivity Theory in the 1980s. Soros managed the legendary Quantum Fund and gained global fame in 1992 when he “broke the Bank of England” by shorting the British pound.

Soros has long challenged the idea that markets are rational. His own trading success—based on identifying when perception diverges from reality—gave weight to his theory. He detailed Reflexivity in several books, especially The Alchemy of Finance, where he explained how understanding these feedback loops helped him make major investment decisions.

How Reflexivity Works in Financial Markets

Reflexivity operates through a two-way feedback loop:

1. Cognitive Function: How Investors Interpret Reality

Investors form opinions based on available information—economic data, news, analysts’ reports, or market sentiment. But these opinions are often biased or incomplete. Humans rely on emotions, narratives, and confidence, not just logic.

2. Manipulative Function: How Their Actions Affect Reality

Investors act on their beliefs—buying when they expect prices to rise or selling when they anticipate decline. This behaviour directly moves markets. As prices change, companies, consumers, and economies respond, altering the very fundamentals investors were observing.

This creates a self-reinforcing cycle:

- Positive perception → buying → rising prices → improving fundamentals → even stronger perception

- Negative perception → selling → falling prices → worsening fundamentals → deeper pessimism

Markets move in boom-bust cycles because these loops continue until they break.

Examples of Reflexivity in Action

1. The Dot-Com Bubble (1999–2000)

Investors believed internet companies would revolutionize the world. This excitement caused massive buying, which inflated valuations. As stock prices soared, companies gained easier access to capital, which temporarily improved their fundamentals—confirming investor optimism. Eventually, reality caught up, leading to a sharp collapse when expectations became unsustainable.

2. The US Housing Bubble (2003–2008)

People believed housing prices could only go up. Banks responded by issuing more loans, buyers rushed into the market, and prices rose further. These rising prices made lenders feel even more secure, triggering more lending. This feedback loop continued until the system collapsed, causing the financial crisis.

3. Soros’s 1992 Short of the British Pound

Soros believed the pound was overvalued and that the UK would not be able to maintain its currency peg. As large investors began selling pounds, pressure increased on the Bank of England. The selling made it harder for the UK to defend the currency—confirming the belief Soros started with. This is a classic reflexive loop where perception shaped reality.

Conclusion: Why Reflexivity Still Matters Today

Reflexivity Theory shows that markets are not driven solely by fundamentals, but also by beliefs, emotions, and behaviour. Understanding this can help investors recognise bubbles early, avoid herd mentality, and identify moments when perception and reality are diverging sharply. Soros’s insight remains relevant because markets continue to react to narratives, confidence, and sentiment just as much as economic data. In a world where information spreads faster than ever, reflexive feedback loops have only grown stronger—making this theory essential for modern investors.