3:5 bonus share: Multibagger railway stock hit 52-week high after bagging first order of KAVACH 4.0 through Progota India to supply Indian Railways

DSIJ Intelligence-1 / 16 Sep 2025 / Categories: Bonus and Spilt Shares, Multibaggers, Trending

The stock has given multibagger returns of 180 per cent from its 52-week low of Rs 971.15 per share and a whopping 350 per cent in 2 years.

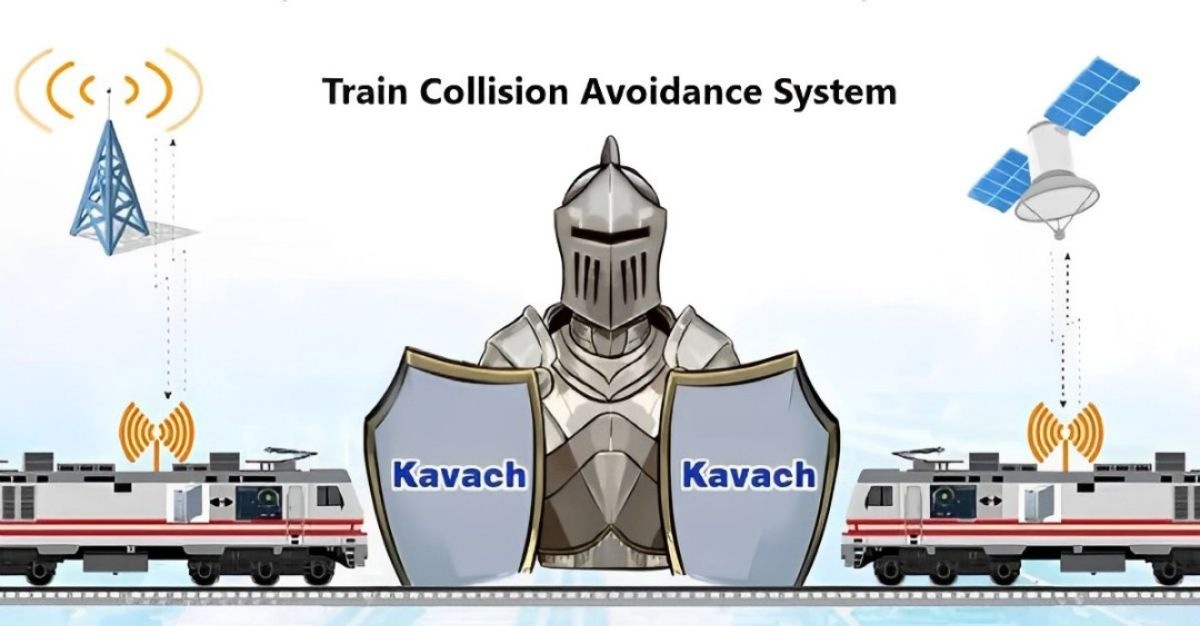

Concord Control Systems Limited (CNCRD) and its associate company, Progota India Private Limited, have secured a significant order for the Kavach 4.0 system, valued at Rs 19.45 crore. This contract marks a major step toward the large-scale implementation of advanced railway safety measures in India. Upon completion, the company will be among a select group of railway suppliers capable of providing a fully developed Kavach system to Indian Railways. Concord's next-generation Kavach system has successfully navigated the rigorous approval process of Indian Railways, with approximately 70 per cent of the demanding SIL4 (Safety Integrity Level 4) certification already completed. The remaining stages of the certification are scheduled to be completed alongside upcoming trials.

The order, received by Progota, covers the design, development, supply, installation, trial, and commissioning of both onboard and trackside Kavach equipment for the South-Central Railway. Because the product was developed entirely in-house, the company has a substantial first-mover advantage in the railway safety electronics market. This is a significant achievement, as new entrants typically take three to five years to reach this stage, highlighting Concord's leadership in technology, regulatory compliance, and speed-to-market. By delivering these advanced, future-ready solutions, Concord Control Systems continues to establish new benchmarks for railway safety innovation in India.

Additionally, the Board of Directors of Concord Control Systems Limited (CCSL) held a meeting and recommended a bonus issue of shares. The proposed ratio for the bonus shares is 3:5, meaning that for every five existing fully paid-up equity shares of Rs. 10 each, shareholders will receive three new fully paid-up equity shares of the same face value. The specific record date to determine shareholder eligibility for the bonus shares will be announced by the company at a later time.

DSIJ’s 'Tiny Treasure' service recommends researched Small-Cap stocks with Inherent Growth Potential. If this interests you, download the service details here.

About the Company

Concord Control Systems Ltd, incorporated in 2011, is a key player in the electrical machinery sector, primarily serving Indian Railways. The company is ISO 9001:2015 certified and recognised as an OEM and RDSO-approved manufacturer. Concord's product portfolio spans railway electrification and coaching, including battery chargers, control panels, testing machines, emergency lighting, and fans. The company is transitioning from a product supplier to a solution provider, with ongoing development of a prototype for control and relay panels. Concord operates manufacturing facilities in Lucknow, Bengaluru, and Hyderabad, and serves both government and private clients, including major entities like Rail Coach Factory Kapurthala and Larsen & Toubro. As of H1FY25, Concord's order book stands at Rs 206 crore, reflecting a steady growth trajectory.

On Tuesday, the shares of Concord Control Systems Limited jumped 4.31 per cent and made a fresh 52-week high of Rs 2,722.95 per share from its previous closing of Rs 2,610.55 per share. Concord Control Systems Limited has a market capitalisation of over Rs 1,700 crore. 3 ace investors, Mukul Mahavir Agrawal holds 2,40,000 shares or 3.81 per cent stake and Ashish Kacholia hold 76,433 shares or a 1.21 per cent stake in the company. Additionally, Asha Mukul Agrawal (wife of Mukul Mahavir Agrawal) bought 95,542 shares or a 1.52 per cent stake. The stock has given multibagger returns of 180 per cent from its 52-week low of Rs 971.15 per share and a whopping 350 per cent in 2 years.

Disclaimer: The article is for informational purposes only and not investment advice.