Vidya Wires Makes Muted Debut Despite Robust Investor Demand

DSIJ Intelligence-1 / 10 Dec 2025/ Categories: IPO, Mindshare, Trending

The muted listing was below the expectations set by the grey market premium (GMP), suggesting investors exercised caution despite the company’s solid business fundamentals.

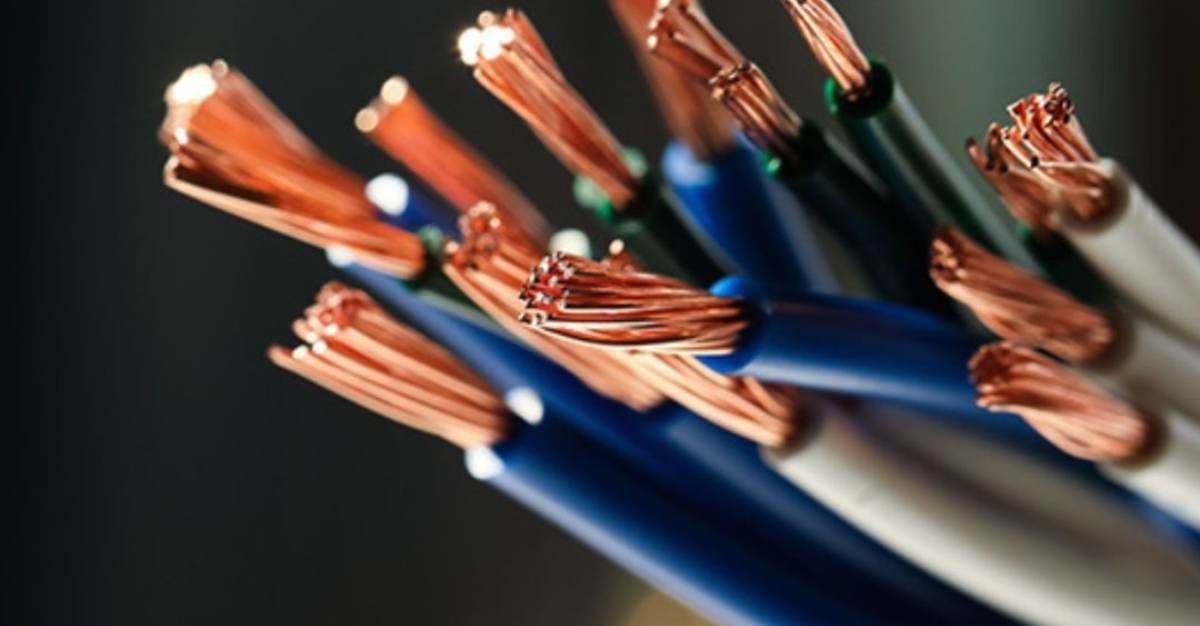

Vidya Wires Limited, a prominent player in the manufacture of copper and aluminium conductors, marked its listing day today, December 10, 2025, on the stock exchanges. While the Initial Public Offering (IPO) saw overwhelming subscription numbers, the stock’s debut was relatively flat, listing in line with the issue price.

Listing Prices and Muted Performance

The stock made a flat entry on the National Stock Exchange (NSE), listing at Rs 52 per share, exactly matching the upper end of its issue price band. On the Bombay Stock Exchange (BSE), it opened marginally higher at Rs 52.13 per share, reflecting a nominal premium of just 0.25 per cent.

The muted listing was below the expectations set by the grey market premium (GMP), suggesting investors exercised caution despite the company’s solid business fundamentals.

Massive Oversubscription in IPO

The Rs 300.01 crore book-built issue, which opened on December 3 and closed on December 5, 2025, witnessed stellar demand, particularly from non-institutional and retail investors.

- The public issue was subscribed to an impressive 28.53 times overall.

- Non-Institutional Investors (NIIs) showed massive interest, oversubscribing their quota by 55.94 times.

- Retail Individual Investors (RIIs) also bid aggressively, subscribing to their portion 29.98 times.

- The Qualified Institutional Buyers (QIBs) segment saw a subscription of 5.45 times.

The strong subscription indicates high confidence in the company's long-term prospects within the power, electrical systems, and clean energy sectors.

Company Profile and Utilisation of Funds

Incorporated in 1981, Vidya Wires is among the top four domestic manufacturers of winding and conductivity products by installed capacity (5.7 per cent market share in FY25). Its product range includes precision-engineered wires, copper strips, PV ribbons, and conductors essential for applications in power transmission, Transformers, motors, and electric vehicles (EVs).

The net proceeds from the fresh issue component of the IPO (Rs 274 crore) are earmarked for strategic growth and financial stability:

- Capital Expenditure: Funding a new manufacturing project in its subsidiary, ALCU, to expand capacity.

- Debt Reduction: Repaying or prepaying a portion of its outstanding borrowings to strengthen the balance sheet.

Despite the flat listing, Vidya Wires is positioned to benefit from the growing domestic demand in core infrastructure, electricity, and the high-growth EV and Solar sectors, making it a critical supplier to the Indian industrial landscape.

Disclaimer: The article is for informational purposes only and not investment advice.