Anil Ambani-backed multibagger debt-free stock hit upper circuit after receiving Letter of Award (LoA) from NHPC Ltd

DSIJ Intelligence-1 / 19 Aug 2025 / Categories: Mindshare, Trending

The stock is up 41.3 per cent from its 52-week low of Rs 195 per share.

On Tuesday, shares of Reliance Group & Anil Ambani-backed infra stock – Reliance Infrastructure Ltd hit a 5 per cent upper circuit to Rs 275.50 per share from its previous closing of Rs 262.40 per share. The stock’s 52-week high is Rs 425 and its 52-week low is Rs 195.

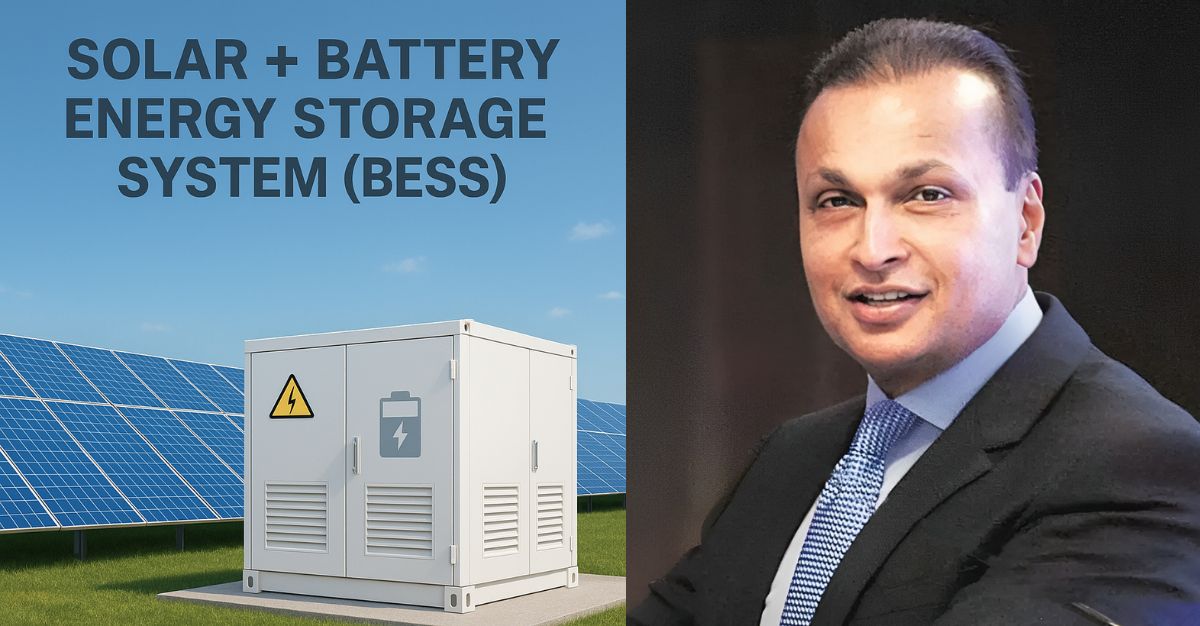

Reliance Infrastructure Limited has received a Letter of Award (LOA) from NHPC for a 390 MW interstate transmission system (ISTS)-connected solar power project integrated with a Battery Energy Storage System (BESS). This project will add a substantial 700 MWp of solar DC capacity and 780 MWhr of BESS capacity to the Reliance Group's portfolio, reinforcing its position in new energy solutions. The winning tariff was Rs 3.13/kWh, making it a highly competitive offering in India's energy transition. The tender, which saw participation from 15 entities and was nearly four times oversubscribed, highlights the growing interest in dispatchable renewable energy solutions.

With this new addition, the combined clean energy pipeline of the Reliance Group, including Reliance Power's existing portfolio, now surpasses 3 GWp of Solar DC capacity and 3.5 GWhr of BESS capacity. This firmly establishes the Reliance Group as India's largest player in the integrated Solar + BESS segment. This achievement marks a significant step in the Group's strategic vision to lead India's renewable energy sector and contribute to the nation's sustainable energy future.

Advertisement:

About the Company

Reliance Group has two prominent companies under its umbrella, Reliance Infrastructure Limited and Reliance Power Limited, which are debt-free with zero outstanding loans from banks or financial institutions. The group's financial strength is reflected in its net worth and annual turnover, each amounting to Rs 33,000 crore, and market capitalisation around Rs 45,000 crore, with a shareholder base exceeding 4 million. Reliance Infrastructure Limited is active in the energy sector, focusing on power distribution in Delhi and power generation. The company also has interests in defence manufacturing and plays a key role in infrastructure development through special purpose vehicles (SPVs), including projects like the Mumbai Metro. Reliance Power, a leading power generation company in India with a total installed capacity of 5,305 MW, includes the 4,000 MW Ultra Mega Power Project in Sasan, Madhya Pradesh, currently the largest integrated thermal power plant in the world.

DSIJ’s 'Tiny Treasure' service recommends researched Small-Cap stocks with Inherent Growth Potential. If this interests you, download the service details here.

The company has a market cap of over Rs 11,000 crore. The stock is up 41.3 per cent from its 52-week low of Rs 195 per share. The promoters of the company own 19.05 per cent, FIIs own 10.26 per cent, DIIs own 1.38 per cent, the Government own 0.01 per cent and the public & others own the rest of the stake, i.e., 69.30 per cent as of June 2025.

Disclaimer: The article is for informational purposes only and not investment advice.