Automotive parts manufacturer commences production of oil pumps for Hero MotoCorp Ltd

DSIJ Intelligence-1 / 14 Jul 2025 / Categories: Mindshare, Trending

The stock is up 46.5 per cent from its 52-week low of Rs 295.20 per share.

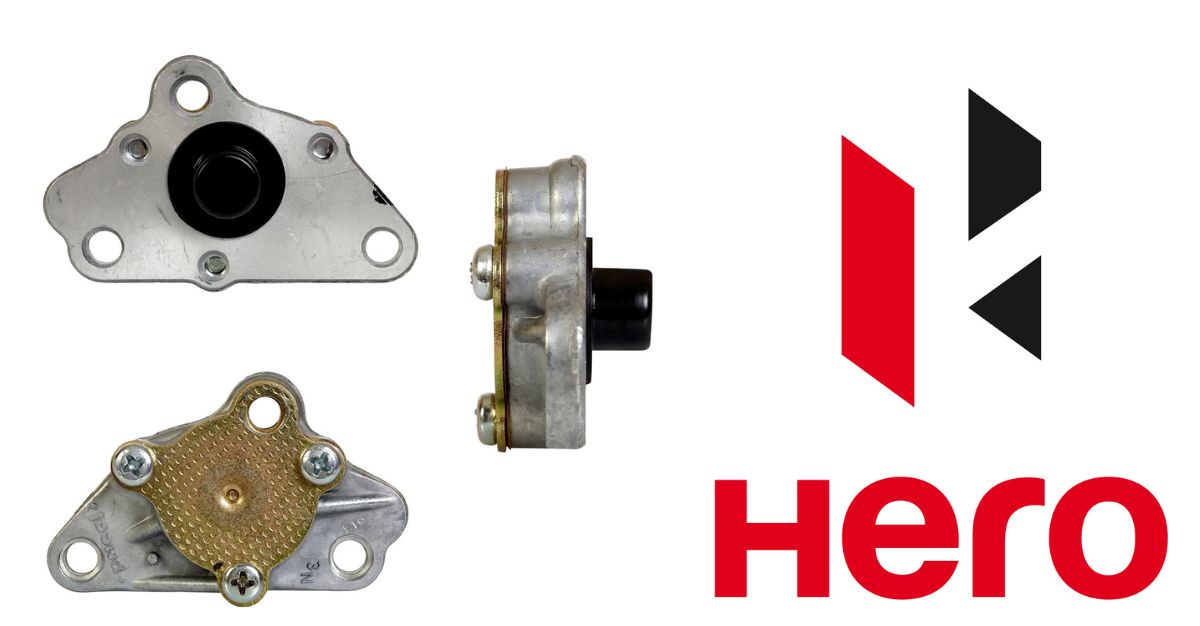

Pavna Industries Limited (NSE: PAVNAIND, BSE: PAVNAIND), among leading manufacturers of wide range of automotive parts for reputed OEMs serving different vehicle segments including passenger vehicles, two-wheelers, three-wheelers, heavy and light commercial vehicles and off-road vehicles, is delighted to inform that one of its subsidiary companies, Pavna Sunworld Autotech Pvt Ltd, has successfully commenced the production and supply of oil pumps to Hero MotoCorp Ltd (HMCL) – India’s largest two-wheeler manufacturer.

Pavna Sunworld Autotech has been commissioned with the supply of oil pumps for HMCL's volume leaders — Splendor and Glamour, for supply to all six of HMCL's Indian plants. This is a milestone in Pavna's increasing association with marquee OEMs and reflects its focus on quality and timely delivery. It has started ramp-up production which will be scaled up progressively, rising to 50,000 units monthly over the next three to four months.

Commenting on this development, Mr. Swapnil Jain, Managing Director, Pavna Industries Ltd said: “We are delighted to announce the production of oil pumps for Hero MotoCorp, India's most respected two-wheeler automotive Company. This achievement is a testament to increasing consumer confidence in Pavna's engineering expertise, operational excellence and product quality." Acquiring this mandate in all six Hero MotoCorp facilities is a reflection of our team's hard work and reinforces our status as a go-to supplier of key engine parts. We are eager to ramp up deliveries over the next few months while delivering the highest levels of performance and reliability.”

Additionally, the company’s Board of Directors approved a 10-for-1 stock split. This means that for every one share currently held with a face value of Rs 10, shareholders will soon have ten shares, each with a face value of Re 1. The company expects this split to make its shares more accessible and appealing to individual investors, which should boost liquidity in the market. The record date for this split will be announced once shareholder approval is secured and the entire process is anticipated to be completed within approximately three months.

DSIJ offers a service 'PAS' which provides stock recommendations that have the potential to generate excellent returns on your portfolio. If this interests you, then do download the service details pdf here

About the Company

Pavna Industries Limited, formerly Pavna Locks Limited, incorporated in 1994, is a well-established manufacturer of a wide range of high-quality automotive parts for various OEMs. With strategically located manufacturing plants, the company produces items like Ignition Switches, Fuel Tank Caps and Oil Pumps and serves key clients such as Bajaj, Kawasaki, Honda, TVS, Mahindra, Escorts, Royal Enfield, Ashok Leyland, Mahindra Wheels, Eicher Motors, Tork Motors, Revolt and Mahindra Electric. PAVNA also engages in extensive R&D, including collaborations with Sunworld Moto Industrial Co and exports to several countries including Italy, Sri Lanka, Indonesia, Sudan, U.S.A. and Bangladesh. Its subsidiary, Pavna Sunworld Autotech, commenced the supply of oil pumps to Hero MotoCorp Ltd for its Splendor and Glamour models.

According to Quarterly Results, the company reported net sales of Rs 66.23 crore and net profit of Rs 1.82 crore in Q4FY25 while in its annual results, the company reported net sales of Rs 308.24 crore and net profit of Rs 8.04 crore in FY25.

In FY25, FIIs bought 8,61,614 shares or 6.18 per cent compared to nil holding in FY24. As of March 2025, Promoters own 61.50 per cent stake, FIIs own 6.18 per cent stake and the remaining 32.32 per cent stake is owned by public shareholders. The company has a market cap of over Rs 580 crore. The shares of the company have a PE of 80x, an ROE of 5 per cent and an ROCE of 10 per cent. The stock is up 46.5 per cent from its 52-week low of Rs 295.20 per share.

Disclaimer: The article is for informational purposes only and not investment advice.