Cable penny stock at Rs 20 in focus as company receives orders from Larsen & Toubro Limited

DSIJ Intelligence-1 / 16 Oct 2025 / Categories: Penny Stocks, Trending

The stock is up by 31 per cent from its 52-week low of Rs 11.99 per share.

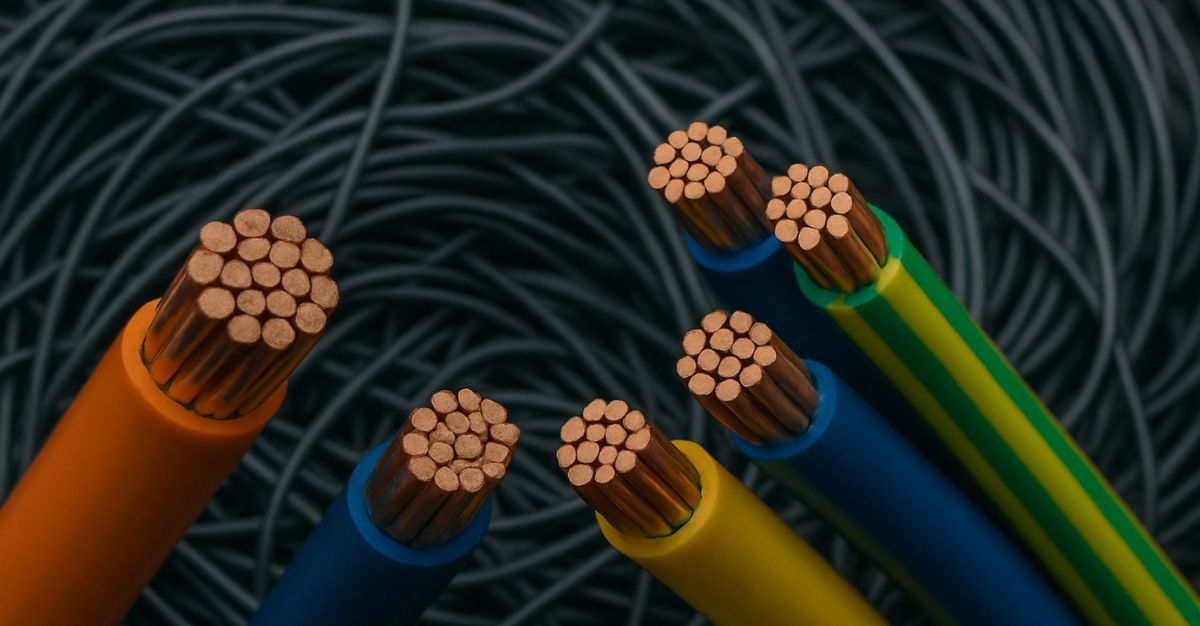

Ultracab (India) Limited has secured two significant domestic contracts from Larsen & Toubro Limited (L&T Construction). The first is a Purchase Order (PO) worth Rs. 50 Crores (inclusive of Taxes) for the supply of LT power and control cables. These cables are designated for an EPC project currently being undertaken by the L&T Construction Division.

This Diwali, 2 years of DSIJ Digital Magazine for the price of 1! Apply MAG1P1. Subscribe Today »

The second award is an Annual Rate Contract (ARC) from L&T Construction. This ARC is for the supply of various cables, including PVC-insulated flexible cables, PVC-insulated heavy-duty armoured cables, and XLPE-insulated armoured cables, covering a total of 63 line items. Both the PO and the ARC are to be executed within one year

The ARC involves supplying goods to over 600 project sites, stores, regional offices, and factories of eight different L&T Group divisions across India. Both contracts were awarded in the ordinary course of business and are collectively expected to positively contribute to Ultracab's overall revenue and reinforce its strong, long-term business relationship with L&T.

About the Company

Ultracab is the leading manufacturer and exporter of electric wires and cables in India and it has grown in leaps and bounds since its incorporation. Ultracab has been working in this domain for more than 26 years. They have the latest technology and advanced machinery for manufacturing technically sound quality products. Ultracab has a very strong presence in the product segment and has prestigious corporate buyers like Tata Group, Adani Group, Jindal Group, Vedanta Group, Different departments of Indian Railways and other PSU companies like EIL, PGCIL, Railways, SAIL, BPCL, MRPL, NPCIL, BHEL and many more.

Ultracab (India) Limited has a market cap of over Rs 120 crore. According to the shareholding pattern of September 2025, the promoters own a 29.50 per cent stake and the rest of the stake is owned by the general public, i.e. 70.50 per cent. The stock is up by 31 per cent from its 52-week low of Rs 11.99 per share.

Disclaimer: The article is for informational purposes only and not investment advice.