How Interest Rate Cycles Affect Equity Valuations!

DSIJ Intelligence-6 / 14 Aug 2025/ Categories: General, Knowledge, Trending

Interest rate cycles are a fundamental driver of equity valuations. By monitoring monetary policy and understanding sector-specific impacts, investors can make informed decisions and protect portfolios from rate-induced volatility.

Interest rates are a key lever used by central banks to manage economic growth and inflation. However, their impact goes far beyond borrowing costs—they play a crucial role in determining equity valuations. For investors, understanding interest rate cycles can help gauge the attractiveness of stocks and optimize portfolio decisions.

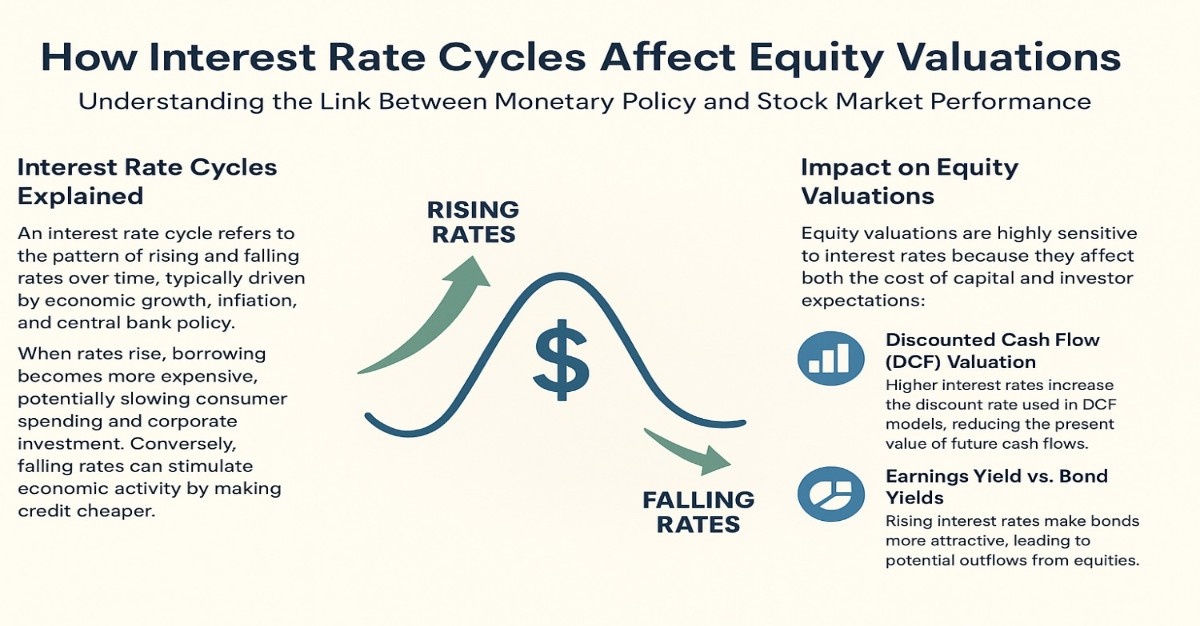

Interest Rate Cycles Explained

An interest rate cycle refers to the pattern of rising and falling rates over time, typically driven by economic growth, inflation, and central bank policy. When rates rise, borrowing becomes more expensive, potentially slowing consumer spending and corporate investment. Conversely, falling rates can stimulate economic activity by making credit cheaper.

Impact on Equity Valuations

Equity valuations are highly sensitive to interest rates because they affect both the cost of capital and investor expectations:

- Discounted Cash Flow (DCF) Valuation: Higher interest rates increase the discount rate used in DCF models, reducing the present value of future cash flows. For example, if a company is expected to generate Rs 100 crore annually for the next five years, a 2 per cent rise in the discount rate can significantly lower its valuation.

- Earnings Yield vs. Bond Yields: Investors compare stock earnings yields to bond yields. Rising interest rates make bonds more attractive, leading to potential outflows from equities. For instance, when the U.S. Federal Reserve hiked rates sharply in 2022, many growth stocks saw valuation compression as bonds offered competitive returns.

- Sector-Specific Effects: Not all sectors respond equally. Financials may benefit from rising rates due to higher net interest margins, while rate-sensitive sectors like real estate and utilities often face valuation headwinds.

Historical Example

During the early 2000s, the U.S. saw a prolonged period of low interest rates following the dot-com bubble burst. Low rates boosted consumer spending and corporate investment, contributing to a surge in equity valuations. Conversely, in 2018, rising rates led to market volatility, especially in high-growth technology stocks, highlighting the inverse relationship between rates and valuations.

Practical Takeaways for Investors

Understanding interest rate cycles can help investors:

- Adjust sector allocation based on rate sensitivity

- Reassess growth stock valuations when rates rise

- Balance portfolios with defensive stocks during tightening cycles

Conclusion

Interest rate cycles are a fundamental driver of equity valuations. By monitoring monetary policy and understanding sector-specific impacts, investors can make informed decisions and protect portfolios from rate-induced volatility. Awareness of these cycles enables a more strategic approach to stock selection and risk management.

DSIJ’s 'multibagger Pick’ service recommends well researched multibagger stocks with High Returns potential. If this interests you, do download the service details here.