How Loans Can Become a Powerful Wealth Weapon; If Used the Right Way

DSIJ Intelligence-7 / 26 Nov 2025 / Categories: Knowledge, Personal Finance, Trending

Turning Smart Borrowing into a Strategic Financial Advantage Instead of a Lifetime Liability

For most people, the word “loan” immediately triggers fear. Debt is seen as something to avoid at all costs. Parents warn their children against its financial advisors often speak cautiously about it and social conditioning labels it as a burden. But the reality is more nuanced. Loans are neither good nor bad by default. They are simply tools and like any tool, their impact depends entirely on how intelligently they are used.

When used poorly, loans destroy wealth.

When used wisely, they can quietly multiply it.

The difference lies in strategy, discipline, and understanding the opportunity cost of money. Let us explore this concept through a real-life example that most people can relate to: buying a car.

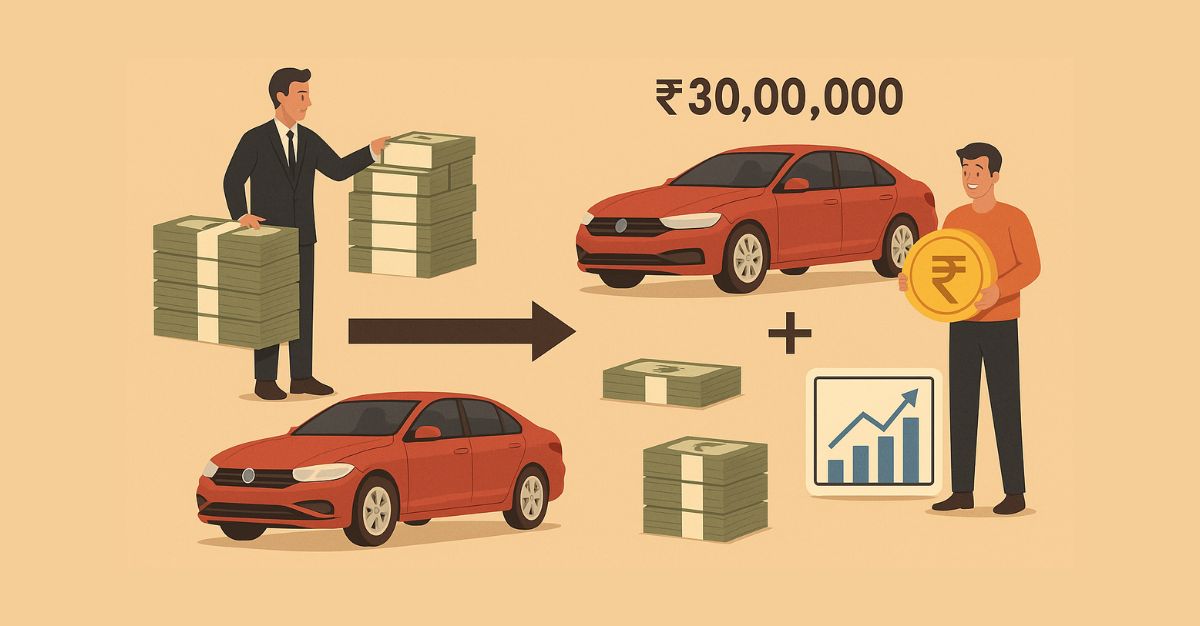

The Rs 30 Lakh Car Dilemma: Emotional vs Strategic Thinking

Imagine you have Rs 30 lakh in hand and wish to buy a car worth Rs 30 lakh. The natural reaction is simple: pay the full amount and enjoy life without EMI stress. Emotionally, this feels “safe” and “responsible.”

But financially, the question should be different: Is it smarter to block Rs 30 lakh in a depreciating asset or use structured borrowing to keep money working for you? Let’s examine both options in detail.

Scenario 1: Full Payment for the Car

You pay Rs 30,00,000 upfront. After five years:

- The car depreciates and is now worth approximately Rs 12–14 lakh.

- You have no lump sum left to invest.

- No passive growth occurred on your capital.

Net Position After 5 Years:

- Car Value ≈ Rs 13 lakh

- Liquid Wealth = Rs 0

- Total Net Worth ≈ Rs 13 lakh

Scenario 2: Strategic Loan + Investing the Capital

Now let’s explore the smarter approach.

Car Price: Rs 30,00,000

Down Payment (20%): Rs 6,00,000

Loan Amount (80%): Rs 24,00,000

Interest Rate: 9%

Tenure: 5 years

EMI Calculation

Monthly EMI ≈ Rs 49,800

Total EMI over 5 years ≈ Rs 29,88,000

Interest Paid ≈ Rs 5,88,000

Instead of spending the full Rs 30 lakh, you invest the remaining Rs 24,00,000 in fixed-income instruments or bonds at a conservative 7.5% return.

Future Value of Rs 24 lakh after 5 years: ≈ Rs 34,50,000

Now subtract loan interest: Rs 34,50,000 – Rs 5,88,000 = Rs 28,62,000

Add car value: Car Value ≈ Rs 13 lakh

Net Position After 5 Years:

Investment retained ≈ Rs 28.6 lakh

Car value ≈ Rs 13 lakh

Total Net Worth ≈ Rs 41.6 lakh

At first glance, this strategy appears far superior. But Here’s the Intelligent Question: What About Saving the EMI? In the full-payment scenario, instead of paying EMI, you could invest the same amount monthly into a Recurring Deposit (RD). This must be factored to make a fair comparison.

Scenario 3: Full Payment + Monthly EMI Investment

You pay Rs 30 lakh upfront but now invest Rs 49,800 every month for 5 years into RD.

Total RD Contribution: Rs 49,800 × 60 = Rs 29,88,000

Future Value of RD @ 7.5%: ≈ Rs 36,40,000

Add car value: ≈ Rs 13 lakh

Net Position After 5 Years:

RD Value ≈ Rs 36.4 lakh

Car Value ≈ Rs 13 lakh

Total Net Worth ≈ Rs 49.4 lakh

Final Wealth Comparison

|

Strategy |

Net Worth After 5 Years |

|

Full Payment Only |

Rs 13 lakh |

|

Loan + Lump Sum Investment |

Rs 41.6 lakh |

|

Full Payment + RD Investment |

Rs 49.4 lakh |

Now the truth becomes clear. If you are highly disciplined and consistently invest the EMI amount each month, the full-payment route creates higher total wealth. So why would anyone choose the loan strategy?

Why Loans Still Make Sense When Used Intelligently

Because reality is not a spreadsheet. Most people who pay upfront:

- Do not invest the EMI equivalent every month.

- End up spending the freed cash on lifestyle upgrades.

- Lose financial discipline over time.

Whereas:

- Loan EMI forces discipline automatically.

- Preserves liquidity.

- Offers financial flexibility.

- Protects capital for emergencies or business opportunities.

Loan becomes powerful when:

- Your investment return exceeds loan interest.

- You deploy retained capital into growth assets.

- You value liquidity and financial leverage.

- You want optionality in life decisions.

When Loan Turns Into a Wealth Weapon

Loans become strategic when used to:

- Invest in assets that grow faster than interest cost

- Create cash-flow-generating businesses

- Preserve capital for compounding opportunities

- Avoid opportunity loss

A depreciating asset like a car should ideally be funded in a way that allows your capital to stay productive elsewhere. The key is not “loan vs no loan.” The key is where your money is working harder.

Borrowing Done Right vs Done Wrong

Wrong Use of Loan:

- EMI for luxury without investment

- Emotional impulse buying

- No financial discipline

- Lifestyle inflation

Smart Use of Loan:

- Controlled leverage

- Capital invested separately

- Risk-adjusted planning

- Preserved liquidity

Loans do not destroy wealth. Poor planning destroys wealth.

The Psychology Behind Smart Borrowing

Most people aim to remove EMI quickly for peace of mind. But financial peace should come from smart structuring, not emotional comfort. A better question to ask is: “Is my money earning more than my loan is costing?” If yes, the loan is financially justified.

A Balanced Approach for Real Life

The smartest individuals often follow a hybrid model: Moderate down payment, Responsible EMI, Parallel investing and Emergency fund buffer. This balances emotional comfort with financial efficiency.

The Core Insight

A car loses value every year. Capital grows when deployed smartly.

The decision should not be: “Should I avoid EMI?”

It should be: “How can I make my money work harder even after buying what I desire?”

Conclusion: A Loan Is Not the Enemy — Ignorance Is

This article proves one clear truth: Loan is not a financial mistake. Unplanned loan is. If you're disciplined, full payment plus investing EMI can create superior wealth. If you value liquidity, flexibility and strategic growth, smart borrowing can outperform emotional decisions.

The real weapon is not loan. The real weapon is financial literacy. When you understand opportunity cost, compounding, and capital allocation, loans transform from burden into strategy. And that is how borrowing becomes one of the most underrated wealth tools of the modern investor.

Disclaimer: The article is for informational purposes only and not investment advice.