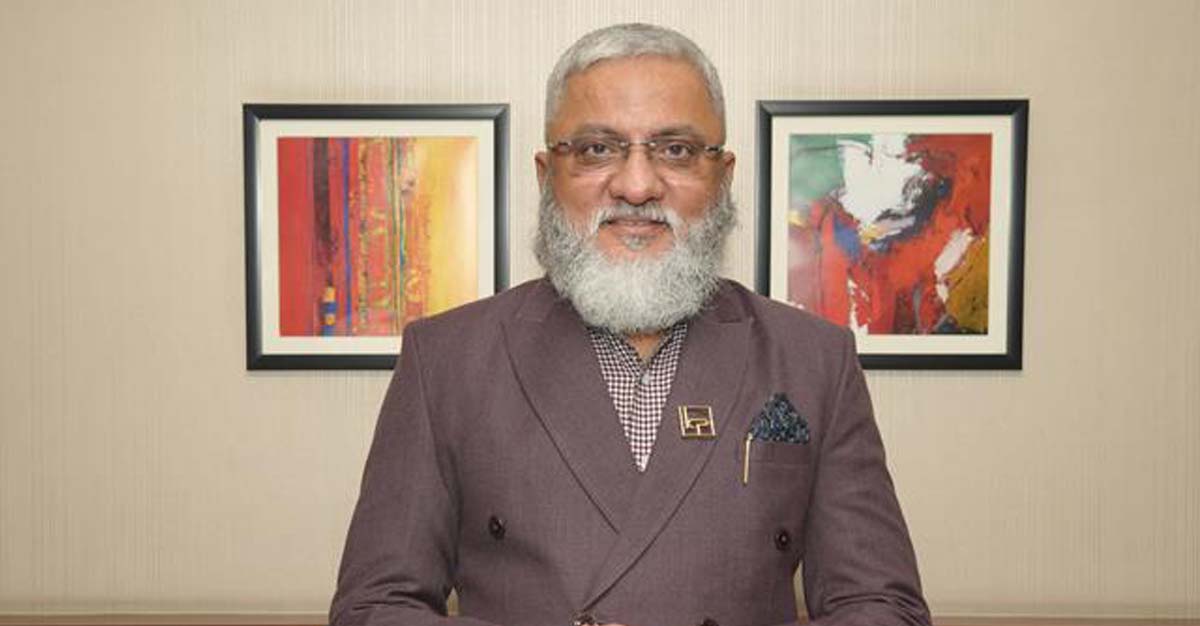

In conversation with Dr Faruk G. Patel, Chairman and Managing Director, KP Group

DSIJ Intelligence-11 / 25 Sep 2025 / Categories: Interviews, Trending

Catch valuable insights on the key growth drivers behind the company’s strong performance, its future targets, pledged shares, strategic initiatives, and upcoming capex plans—take a look!

Could you walk us through the main drivers behind the 75 per cent revenue growth and 68 per cent net profit growth in Q1FY26?

Growth for us at KPI Green Energy is driven because of discipline, not mere ambition. In Q1FY26, 75 per cent of our revenue growth and 68 per cent of the net profit growth have been achieved mainly due to three key factors. First, a steady ramp-up of our IPP business, where our solar power plants are contributing consistent annuity-based revenues; second, the robust growth of our CPP segment, where demand from industrial consumers for green energy continues to expand; and third, our operational excellence, where we have focussed on different aspects of business, from project execution speed to optimising our cost structures. It is the confidence of KPI Green Energy customers, combined with India’s policy push for renewable energy, that has provided us with a strong growth runway.

Also, we are aggressively implementing our proprietary solar-based panel cleaning robots at all our sites, which not only helps us in savings, but also helps the environment by saving water. We take pride in our innovative approach to Operations and Maintenance (O&M), leveraging a state-of-the-art Centralised Monitoring System (CMS) and a dedicated Network Operations Centre (NOC). This system enables us to monitor, analyse, and address any issues promptly, leading to increased asset efficiency and reduced downtime.

Could you give us insights into the product portfolio and revenue contribution across segments, and also highlight your FY26 targets?

KPI Group operates on a business model that is unique, as we follow a hybrid format. Under this style of functioning, we operate in dual roles. One as an Independent Power Producer (IPP), creating long-term annuity income, and two, as a Captive Power Producer (CPP), offering B2B solutions for industries keen to transition to renewable energy. If we look at revenue generation, currently, about 55-60 per cent comes from CPP, while the IPP segment contributes to the balance with higher predictability. Our target for FY26 is to add another 300+ MW capacity across both verticals. The idea is to have a sharper focus on expanding our IPP portfolio and build stronger recurring revenue sources. We are also, alongside, diversifying into delivering newer solutions including hybrid wind-solar projects, battery storage, and floating solar, which will add depth to our product portfolio.

Could you shed some light on the company’s pledged shares? Does the sharp 90 per cent year-on-year growth in cash profit provide greater flexibility in addressing pledged shares and executing capex?

We would like to highlight that the pledge of shares is not for raising funds; it has been provided solely as collateral against project term loans taken earlier. As those facilities migrated from Power Finance Corporation (PFC) to SBI, the collateral pledge was simply carried forward. In our latest SBI sanction, we have written confirmation that post COD—six months after project (250 MW & 370 MW) completion—SBI will release the entire pledge. We are therefore actively working toward clearing the pledge at the earliest. The prime security for these loans remains the projects themselves and their underlying cash flows; the share pledge is only a supplementary collateral.

Yes, our balance sheet has strengthened meaningfully, with approximately 90 per cent year-on-year growth in cash profit. This improved internal accrual base gives us ample headroom to execute capex and sustain growth, without compromising liquidity or covenants.

Thereby, at KPI Group, our philosophy is clear: we deploy capital to fuel growth while safeguarding stakeholders’ interests through conservative security structures and predictable cash flow.

How does KPI Green Energy manage its working capital cycle to ensure efficient cash flow?

KPI Green Energy follows a very disciplined approach towards its working capital. In our CPP segment, we have aligned project execution closely with advance payments and milestone-based collections, which ensures minimal cash flow mismatch. Similarly, in our IPP business, annuity income from long-term PPAs has helped create predictable cash inflows. The depreciation claimed from IPP assets is used to offset profits from CPP projects, reducing tax outlay and strengthening our cash flows. This combination allows us to manage liquidity efficiently and deploy capital swiftly for new opportunities. In fact, our working capital cycle has consistently improved and is the best reflection of our robust internal controls and customer-centric approach. KP Group is gradually shifting its focus towards building the IPP portfolio, which is highly profitable.

With the incorporation of KPIN Clean Power One LLP, what strategic advantages do you foresee for the company over the long term?

The incorporation of KPIN Clean Power One LLP is part of our strategic move to institutionalise and accelerate the company’s growth trajectory. This entity is planned to be used as an SPV to house renewable projects. It serves us as a dedicated platform to pursue larger-scale renewable energy projects, attract marquee investors, and potentially explore partnerships. In the innovative clean energy solutions space, over the long term, such a structure allows us to segregate business lines more effectively. It helps ensure transparent governance and create value-enhancing opportunities for all stakeholders, going beyond capacity expansion to building resilience and scalability for the next decade.

How does the company plan to capitalise on emerging opportunities in high-growth areas such as BESS solutions, floating solar, and green hydrogen projects?

For KPI Green Energy, these high-growth areas are the future of energy, rather than still being ‘emerging’ opportunities. For instance, Battery Energy Storage Systems (BESS) are critical to solving the intermittency challenge, and we are actively evaluating pilot projects in this space. Floating solar, with its efficiency and land-optimisation benefits, is another area where we are working on feasibility studies, and green hydrogen is where India has a chance to lead through this global energy transition phase. In this regard, we are already in advanced discussions with technology partners and exploring collaborations for pilot-scale hydrogen production.

For KPI, the strategy is clear. We must be early, agile, and scalable in these new-age solutions, while leveraging KPI’s proven execution track record in solar and hybrid projects.

I would also like to highlight a significant milestone we achieved recently—the listing of KPI Green Energy’s Green Bonds on NSE, making us the first in India to do so. This move has unlocked a new channel of sustainable financing, aligned with our commitment to ESG principles, and will directly support these high-growth initiatives like storage, floating solar, and hydrogen.

Our strategy is simple: to be early, agile, and scalable in these new-age solutions, while leveraging our proven execution track record in solar and hybrid projects.