Leading Indicators to Assess Future Company Performance!

DSIJ Intelligence-6 / 18 Aug 2025/ Categories: General, Knowledge, Trending

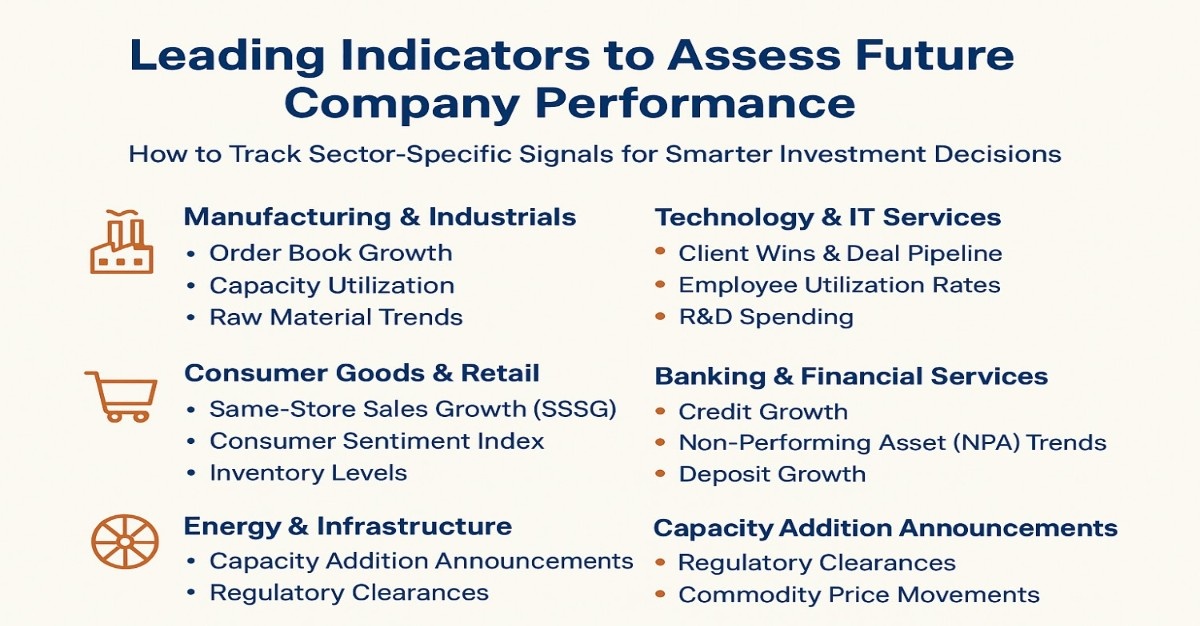

For investors, tracking sector-specific leading indicators is like reading tomorrow’s headlines today. Whether it’s order books in manufacturing, SSSG in retail, or credit growth in banking, these signals offer a forward-looking edge.

When evaluating a company’s future potential, investors often focus on financial statements. While past numbers provide clarity, they may not always reflect the road ahead. This is where leading indicators, metrics and signals that precede performance trends become essential. By studying sector-specific indicators, one can gauge growth opportunities and risks before they show up in financials.

Why Leading Indicators Matter

Unlike lagging indicators such as revenue or net profit, leading indicators capture early shifts in demand, efficiency, or market sentiment. They help investors anticipate performance, assess sector outlook, and identify potential outperformers. However, the right indicators vary across industries, making it important to adopt a tailored approach.

Key Leading Indicators Across Sectors

Manufacturing & Industrials

- Order Book Growth: A rising backlog suggests healthy demand ahead.

- Capacity Utilization: Higher utilization often signals expansion needs and revenue growth.

- Raw Material Trends: Input price stability or declines can improve margins.

Technology & IT Services

- Client Wins & Deal Pipeline: Large, long-term contracts hint at revenue visibility.

- Employee Utilization Rates: Efficient resource allocation indicates profitability.

- R&D Spending: Higher investment in innovation may drive future competitiveness.

Consumer Goods & Retail

- Same-Store Sales Growth (SSSG): Tracks whether existing outlets are attracting repeat demand.

- Consumer Sentiment Index: Reflects spending appetite, especially in discretionary segments.

- Inventory Levels: Rising inventory without matching demand could point to slower sales.

Banking & Financial Services

- Credit Growth: Expanding loan books suggest improving economic activity.

- Non-Performing Asset (NPA) Trends: Falling NPAs indicate healthier balance sheets.

- Deposit Growth: Strong inflows enhance lending capability.

Energy & Infrastructure

- Capacity Addition Announcements: Expansion reflects long-term demand confidence.

- Regulatory Clearances: Faster approvals often lead to quicker execution.

- Commodity Price Movements: Oil, coal, or power tariffs heavily influence profitability.

Balancing Indicators with Fundamentals

While leading indicators provide valuable foresight, they should be analysed alongside company fundamentals such as balance sheet strength, management quality, and sector dynamics. Overreliance on a single signal may lead to misjudgement but using them in combination creates a more reliable investment framework.

Conclusion

For investors, tracking sector-specific leading indicators is like reading tomorrow’s headlines today. Whether it’s order books in manufacturing, SSSG in retail, or credit growth in banking, these signals offer a forward-looking edge. By blending them with financial analysis, investors can make sharper, more informed decisions about which companies are best positioned for sustainable growth.

DSIJ’s 'multibagger Pick’ service recommends well researched multibagger stocks with High Returns potential. If this interests you, do download the service details here.