Market Capture Ratio: A Smart Measure of Fund Performance in Different Market Cycles!

DSIJ Intelligence-6 / 12 Nov 2025 / Categories: General, Knowledge, Trending

The market capture ratio offers a clear, data-driven view of how an investment performs in different market phases.

What Is the Market Capture Ratio?

The market capture ratio is a performance metric used to evaluate how a Mutual Fund, portfolio, or investment strategy performs relative to a benchmark index during periods of market gains and losses. It is divided into two key components — the up-market capture ratio and the down-market capture ratio.

The up-market capture ratio measures how well a fund performs when the benchmark rises, while the down-market capture ratio indicates how much of the market’s decline the fund captures when the benchmark falls. These ratios help investors assess whether a fund is outperforming in good times and protecting capital during downturns.

How the Ratio Is Calculated

The ratios are typically expressed as percentages:

- Up-Market Capture Ratio = (Fund’s returns during up markets ÷ Benchmark’s returns during up markets) × 100

- Down-Market Capture Ratio = (Fund’s returns during down markets ÷ Benchmark’s returns during down markets) × 100

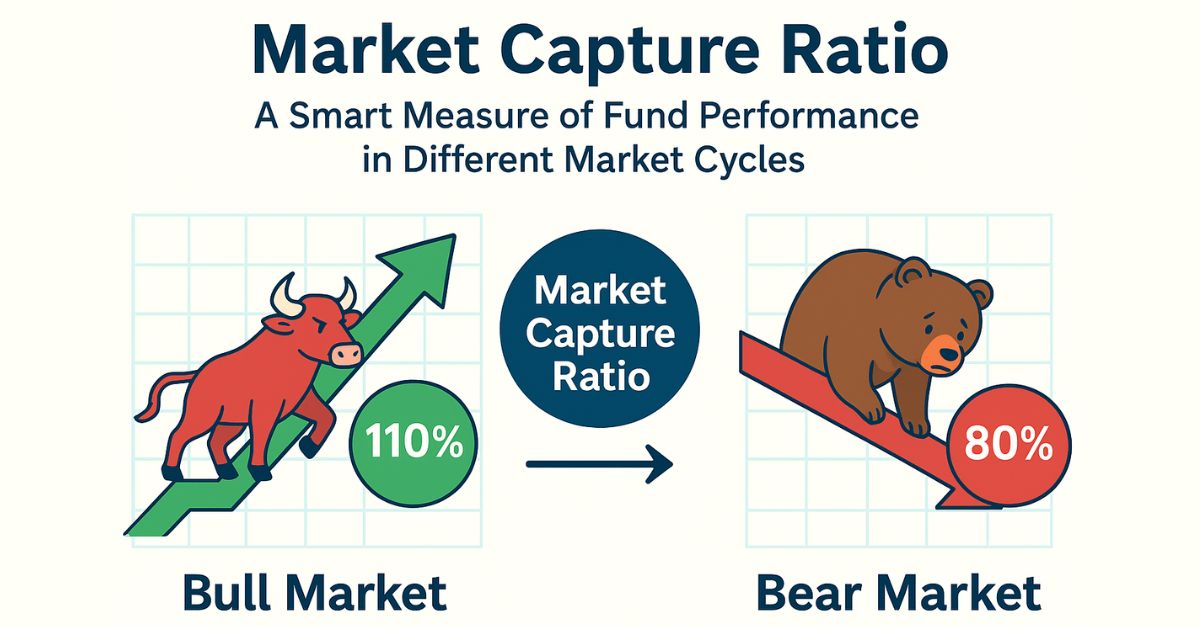

For instance, if a fund’s up-market capture ratio is 110 per cent, it means the fund outperformed the benchmark by 10 per cent during market rallies. Similarly, a down-market capture ratio of 80 per cent implies the fund lost only 80 per cent of what the benchmark lost in market declines — showing better downside protection.

How to Interpret the Ratios

An ideal fund aims for a high up-market capture ratio (above 100 per cent) and a low down-market capture ratio (below 100 per cent). Together, these indicate strong participation in rising markets and resilience in falling ones.

For example:

- A fund with 115 per cent up-capture and 85 per cent down-capture demonstrates efficient risk-adjusted performance.

- Conversely, a fund with 95 per cent up-capture and 110 per cent down-capture may underperform its benchmark across cycles.

These ratios thus offer a practical way to measure consistency, risk control, and the manager’s skill in navigating volatility.

Using Market Capture Ratios in Portfolio Decisions

Investors can use market capture ratios to:

- Compare funds with similar benchmarks to identify consistent outperformers.

- Assess defensive vs. aggressive strategies — defensive funds often have lower down-capture ratios.

- Enhance diversification, selecting funds that perform differently across cycles.

- Evaluate fund managers for their ability to manage risk during turbulent markets.

Conclusion

The market capture ratio offers a clear, data-driven view of how an investment performs in different market phases. It complements metrics like alpha and Sharpe ratio by revealing how much of the market’s upside and downside a fund actually “captures.” For long-term investors, choosing funds with a strong up-market and low down-market capture ratio can significantly improve returns while minimizing risk — making it an essential tool in informed portfolio Construction.