Penny stock below Rs 10: Salasar Techno Engineering Ltd allots 2,11,80,000 equity shares on conversion of warrants to 3 promoters

DSIJ Intelligence-1 / 14 Oct 2025 / Categories: Penny Stocks, Trending

The stock is up by 27.4 per cent from its 52-week low of Rs 6.89 per share and has given multibagger returns of over 300 per cent in 5 years.

On Tuesday, shares of Salasar Techno Engineering Ltd zoomed 1.62 per cent to Rs 8.78 per share from its Intraday low of Rs 8.64 per share. The stock’s 52-week high is Rs 20.15 per share and its 52-week low is Rs 6.89 per share.

The Finance Committee of Salasar Techno Engineering Limited (STEL) approved the allotment of 2,11,80,000 fully paid-up equity shares with a face value of Re 1 each, following the conversion of an equal number of fully convertible warrants. This preferential allotment was made to the Promoter Category (Shashank Agarwal, Shalabh Agarwal, and Bharat Agarwal) at an issue price of Rs 14.40 per share. The company received the balance amount of Rs 22,87,44,000 (Rs 10.80 per warrant, being 75 per cent of the issue price) upon the allottees exercising their conversion rights.

Consequently, the issued and paid-up capital of STEL has increased to Rs 174,79,50,290, consisting of 174,79,50,290 equity shares of Re 1 each, which rank pari-passu with the existing shares. After this conversion, 3,25,00,000 warrants remain outstanding and are convertible into an equal number of equity shares by paying the remaining Rs 10.80 per warrant within 18 months from the original allotment date.

About the Company

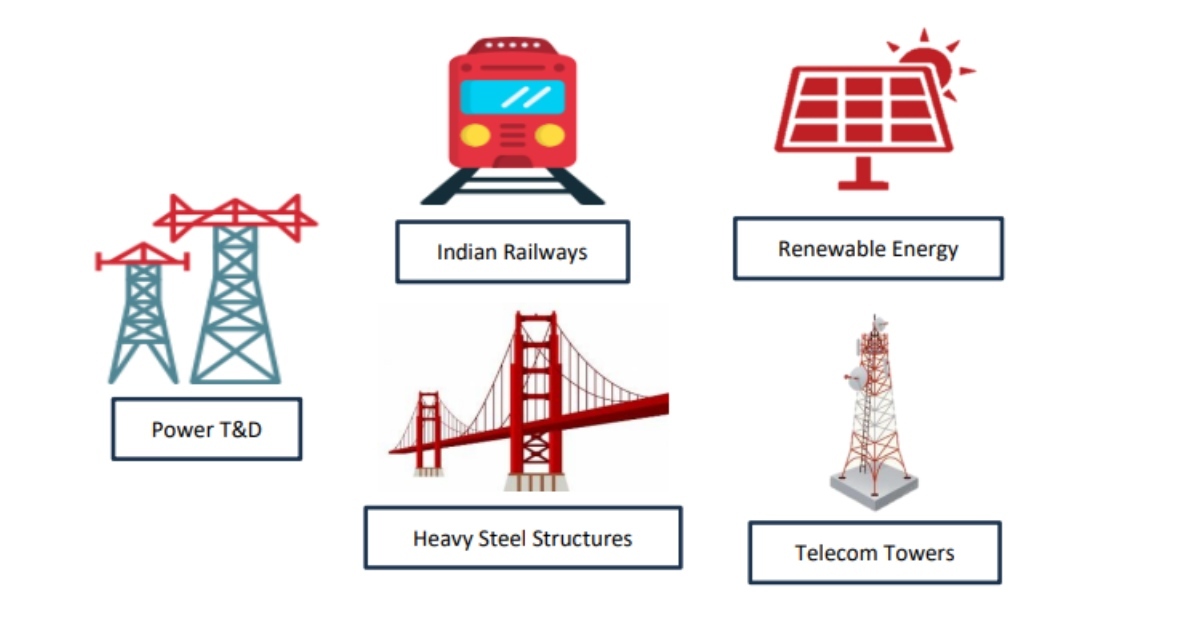

Established in 2006, Salasar Techno Engineering Limited (STEL) is a leading provider of customised steel infrastructure solutions in India. They offer a comprehensive range of services, including engineering, design, fabrication, galvanisation and installation. STEL's product portfolio includes various towers (telecom, power transmission, lighting, etc.), substations, Solar structures, Railway electrification components, bridges and custom steel structures. Moreover, they act as an EPC contractor, managing complete projects for rural electrification, power lines and solar plants.

According to Quarterly Results (Q1FY26), the net sales of Rs 300.17 crore and the net profit of Rs 8.79 crore. In FY25, the company reported net sales of Rs 1,447.43 crore and net profit of Rs 19.13 crore. The company has a market cap of over Rs 1,400 crore and as of December 31, 2024, STEL has a strong Order Book of Rs 2,198 crore. The stock is up by 27.4 per cent from its 52-week low of Rs 6.89 per share and has given multibagger returns of over 300 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.