Penny stock under Rs 10: Salasar Techno Engineering Ltd Secures Stable Outlook from Infomerics Valuation and Ratings Ltd

DSIJ Intelligence-1 / 09 Oct 2025 / Categories: Penny Stocks, Trending

The stock is up by 27.4 per cent from its 52-week low of Rs 6.89 per share and has given multibagger returns of over 300 per cent in 5 years.

On Thursday, shares of Salasar Techno Engineering Ltd zoomed 0.6 per cent to Rs 8.78 per share from its previous closing of Rs 8.73 per share. The stock’s 52-week high is Rs 20.15 per share and its 52-week low is Rs 6.89 per share.

Salasar Techno Engineering Limited (STEL) informed that its credit ratings have been revised by M/s Infomerics Valuation and Ratings Ltd. The key update is the removal of the 'Rating Watch with Developing Implication (RWDI)' status previously attached to the company's long-term and short-term Bank facilities. Infomerics, after reviewing the operational and financial performance through Q1FY2026, reaffirmed the Long Term Bank Facilities rating at 'IVR A' and the Short Term Bank Facilities rating at 'IVR A1', concurrently assigning a 'Stable Outlook' to the long-term debt. This decisive action by the rating agency indicates a resolution of the immediate uncertainties that had prompted the previous rating watch.

The positive change in outlook pertains to the company's total rated bank facilities, which amount to a substantial Rs. crore, covering working capital loans, term loans, and both long-term and short-term non-fund-based facilities like bank guarantees and letters of credit. The assignment of a 'Stable Outlook' following the removal of the watch is considered a positive signal for both lenders and investors, reflecting Infomerics’ improved confidence in STEL's ability to maintain financial consistency and manage its credit risk profile in the near-to-medium term. The rating agency also noted that the assigned ratings are valid for one year, subject to regular surveillance.

About the Company

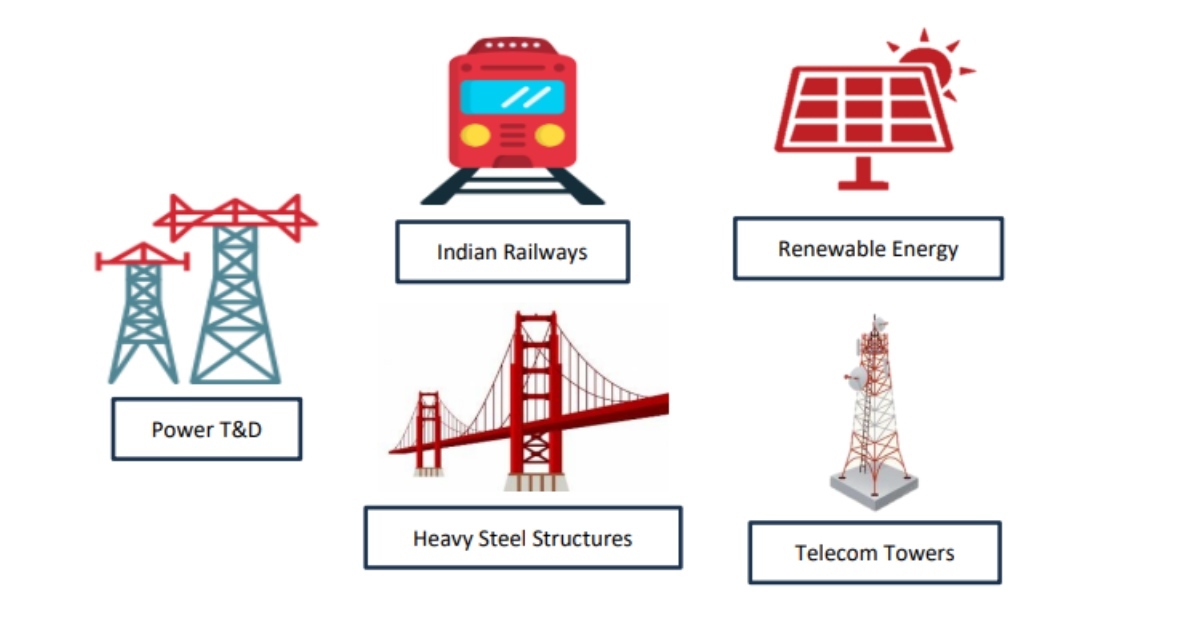

Established in 2006, Salasar Techno Engineering Limited (STEL) is a leading provider of customised steel infrastructure solutions in India. They offer a comprehensive range of services, including engineering, design, fabrication, galvanisation and installation. STEL's product portfolio includes various towers (telecom, power transmission, lighting, etc.), substations, Solar structures, Railway electrification components, bridges and custom steel structures. Moreover, they act as an EPC contractor, managing complete projects for rural electrification, power lines and solar plants.

According to Quarterly Results (Q1FY26), the net sales of Rs 300.17 crore and the net profit of Rs 8.79 crore. In FY25, the company reported net sales of Rs 1,447.43 crore and net profit of Rs 19.13 crore. The company has a market cap of over Rs 1,500 crore and as of December 31, 2024, STEL has a strong Order Book of Rs 2,198 crore. The stock is up by 27.4 per cent from its 52-week low of Rs 6.89 per share and has given multibagger returns of over 300 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.