Rs 2,19,600 crore order book: Thermal power company-BHEL reports a turnaround net profit of Rs 375 crore, QoQ

DSIJ Intelligence-1 / 31 Oct 2025 / Categories: Mindshare, Trending

The company’s order book stands at Rs 2,19,600 crore and the stock is up over 50 per cent from its 52-week low of Rs 176 per share.

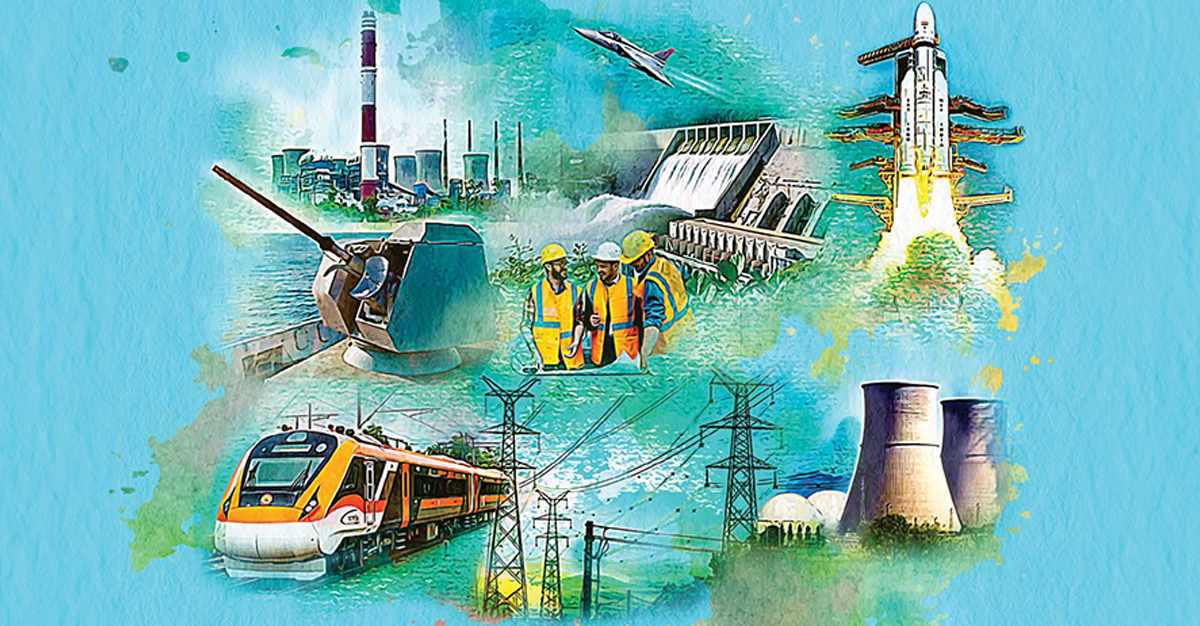

Bharat Heavy Electricals Ltd (BHEL), a leading public sector enterprise under the Ministry of Heavy Industries and Public Enterprises, has been at the forefront of India's power sector for over six decades. With a strong track record in the design, engineering, and manufacturing of a wide range of power generation equipment, BHEL has played a pivotal role in powering the nation's economic growth. BHEL Limited manufactures various power plant equipment.

Also Read DSIJ Blog: Fed Cuts Rates for Second Time: What It Means for India and Will RBI Follow Suit?

Results: According to the Quarterly Results (Q2FY26), the net sales increased by 37 per cent to Rs 7,512 crore compared to net sales of Rs 5,487 crore in Q1FY26. The company reported a turnaround net profit of Rs 375 crore in Q2FY26 compared to a net loss of Rs 456 crore in Q1FY26, an increase of 182 per cent. In H1FY26, the company reported net sales of Rs 12,999 crore and a net loss of Rs 81 crore. In its annual results, the net sales increased by 19 per cent to Rs 28,339 crore and net profit increased by 97 per cent to Rs 513 crore in FY25 compared to FY24.

The company has a market cap of over Rs 80,000 crore. The President of India’s portfolio owns 63.17 per cent and Life Insurance Corporation of India’s portfolio owns 6.88 per cent as of September 2025. The company’s Order Book stands at Rs 2,19,600 crore and the stock is up over 50 per cent from its 52-week low of Rs 176 per share.

Disclaimer: The article is for informational purposes only and not investment advice.