Rs 3,628 Crore Order Book: Power Conductor Company Receives Order of Rs 220.18 Crore from Madhya Gujarat Vij Company Ltd

DSIJ Intelligence-1 / 08 Jul 2025 / Categories: Multibaggers, Trending

The stock has given multibagger returns of 125.3 per cent from its 52-week low of Rs 636.50 per share.

On Tuesday, shares of Rajesh Power Services Limited (RPSL) gained 6.2 per cent to Rs 1,434 per share from its previous closing of Rs 1,350.10 per share. The stock’s 52-week high is Rs 1,572.95 per share and its 52-week low is Rs 636.50 per share. The shares of the company saw a spurt in volume by more than 3 times on the BSE.

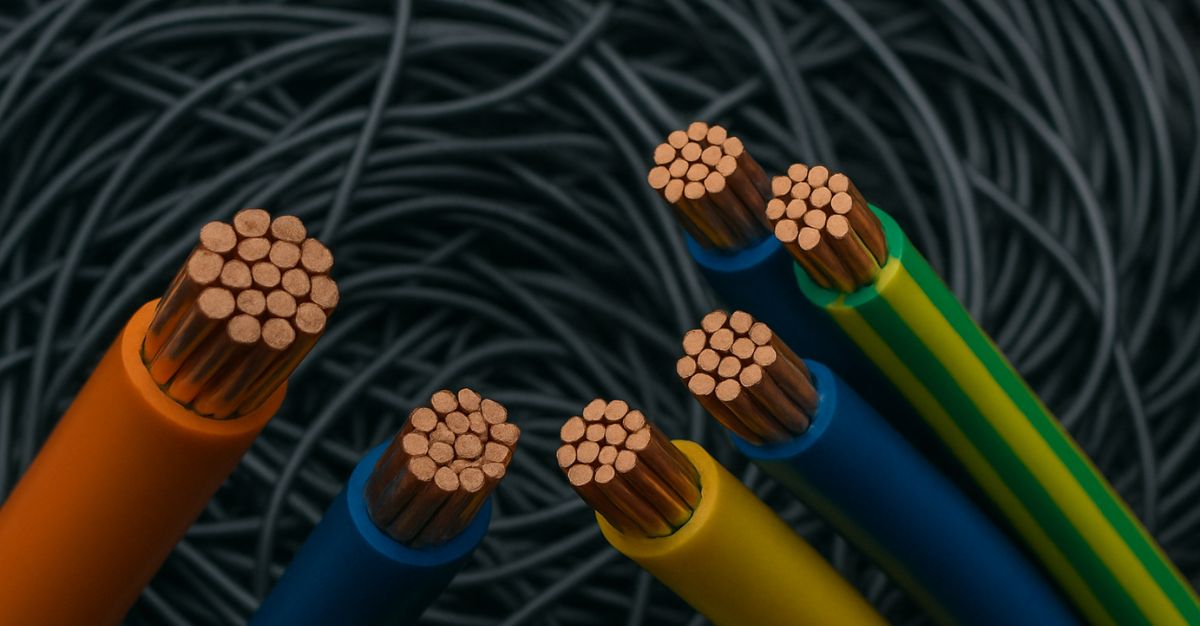

Rajesh Power Services Limited (RPSL), a leading EPC contractor in Power Transmission & Distribution, has secured a domestic turnkey contract valued at Rs 220.18 Crore from Madhya Gujarat Vij Company Limited (MGVCL), Vadodara, Gujarat. This significant order involves the supply, installation, testing, and commissioning of 11KV Medium Voltage Covered Conductors (MVCC) across various locations. The project falls under the Kisan Suryoday Yojana (KSY) Scheme and Vanbandhu Kalyan Yojana (VKY-2) Scheme, and is slated for execution within nine months.

DSIJ’s 'Tiny Treasure' service recommends researched Small-Cap stocks with Inherent Growth Potential. If this interests you, download the service details here.

About Rajesh Power Services Limited (RPSL)

RPSL is one of the leading specialised Engineering, Procurement & Construction (EPC) companies engaged in the Power Transmission & Distribution Sector. RPSL is providing its services across various verticals, including turnkey execution of GIS substations, AIS substations, extra high voltage power cables and transmission lines, and the construction of distribution systems. A concentrated, customer-focused approach and the mission to deliver top-class quality have enabled RPSL to maintain its position in its core business area for over five decades.

The company caters to government and institutional customers across India. The company has a market cap of over Rs 2,500 crore and as of March 31, 2025, the order book stands at Rs 3,628 crore. The shares of the company have a PE of 27x, an ROE of 51 per cent and an ROCE of 55 per cent. The stock has given multibagger returns of 125.3 per cent from its 52-week low of Rs 636.50 per share.

Disclaimer: The article is for informational purposes only and not investment advice.