Rs 650.72 crore order book: Cable penny stock under Rs 65 jumps after board approves Rs 135 crore FCCB and 50 lakh warrants allotment to promoters!

DSIJ Intelligence-1 / 21 Jul 2025 / Categories: Multibaggers, Penny Stocks, Trending

Over a decade, the stock has soared from Rs 2.35 per share to Rs 61.19 per share, achieving multibagger returns of 2,504 per cent.

On Monday, shares of Paramount Communications Ltd surged by 3.66 per cent to Rs 61.19 per share from its previous closing of Rs 59.03 per share. Over the past year, the stock's price has fluctuated between a 52-week high of Rs 100.69 and a 52-week low of Rs 44.59.

Paramount Communications Ltd's Board of Directors has approved two key fundraising initiatives. Firstly, the company intends to issue Foreign Currency Convertible Bonds (FCCBs) for an amount not exceeding Rs 135 crore. These FCCBs can be listed or unlisted and will be issued in one or more tranches, subject to all necessary shareholder, regulatory, and statutory approvals. A "Fund-Raising Committee" has been authorised to determine the specific terms and conditions of this proposed fundraising.

Secondly, the board has approved a preferential allotment of up to 50,00,000 convertible warrants to the Promoter Group category, specifically to Hertz Electricals (International) Private Limited. These warrants, priced at Rs 60 per warrant, will enable the company to raise additional capital. Each warrant is convertible into an equivalent number of equity shares within 18 months from the allotment date, with 25 per cent of the consideration payable at the time of subscription and allotment, and the remaining 75 per cent upon conversion. This preferential issue is also subject to regulatory and shareholder approval at an upcoming Extraordinary General Meeting.

DSIJ’s 'Tiny Treasure' service recommends researched Small-Cap stocks with Inherent Growth Potential. If this interests you, download the service details here.

About the Company

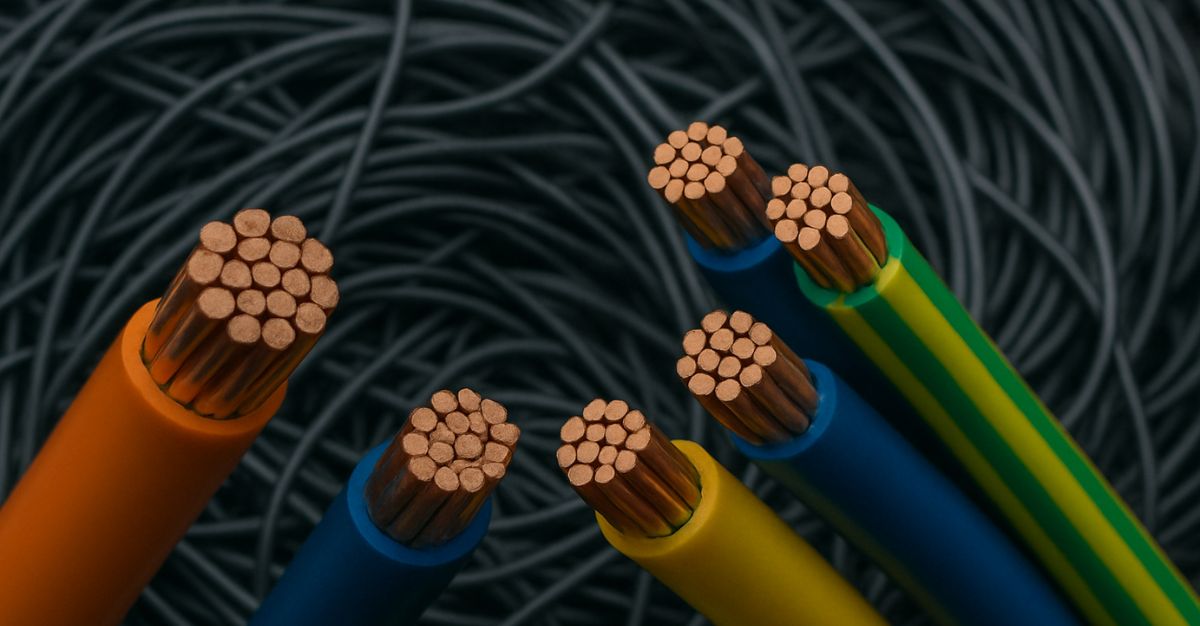

Paramount Communications Ltd produces a variety of wires and cables, including power cables, telecom cables, railway cables, and specialised cables. The company boasts a substantial client base, including esteemed organisations such as Larsen & Toubro, Steel Authority of India (SAIL), BSES, Bharat Heavy Electrical Ltd, Power Grid Corporation, BSNL, Tata Steel, Alcatel Lucent Enterprises, ISRO, Indian Railways, Indian Oil, NTPC, among others.

The company reported strong financial performance for both the second quarter of fiscal year 2025 (Q4FY25) and the annual results (FY25). In Q4FY25, the company reported net sales of Rs 507 crore and net profit of Rs 19 crore while in its FY25 results, the company reported net sales of Rs 1,576 crore and net profit of Rs 87 crore.

The company has a robust order book of Rs 650.72 crore and is experiencing strong sales across all product lines, especially power and railway cables. The company's shares have an ROE of 13 per cent and an ROCE of 17 per cent. The stock gave multibagger returns of 450 per cent in just 3 years and a whopping 810 per cent in 5 years. Over a decade, the stock has soared from Rs 2.35 per share to Rs 61.19 per share, achieving multibagger returns of 2,504 per cent.

Disclaimer: The article is for informational purposes only and not investment advice.