Rs 7,237 crore order book: Railway wagons company bags domestic order of Rs 36,27,70,000 from Transport Corporation of India Ltd

DSIJ Intelligence-1 / 05 Jul 2025 / Categories: Multibaggers, Trending

The stock gave multibagger returns of 300 per cent in 3 years and a whopping 560 per cent in 5 years.

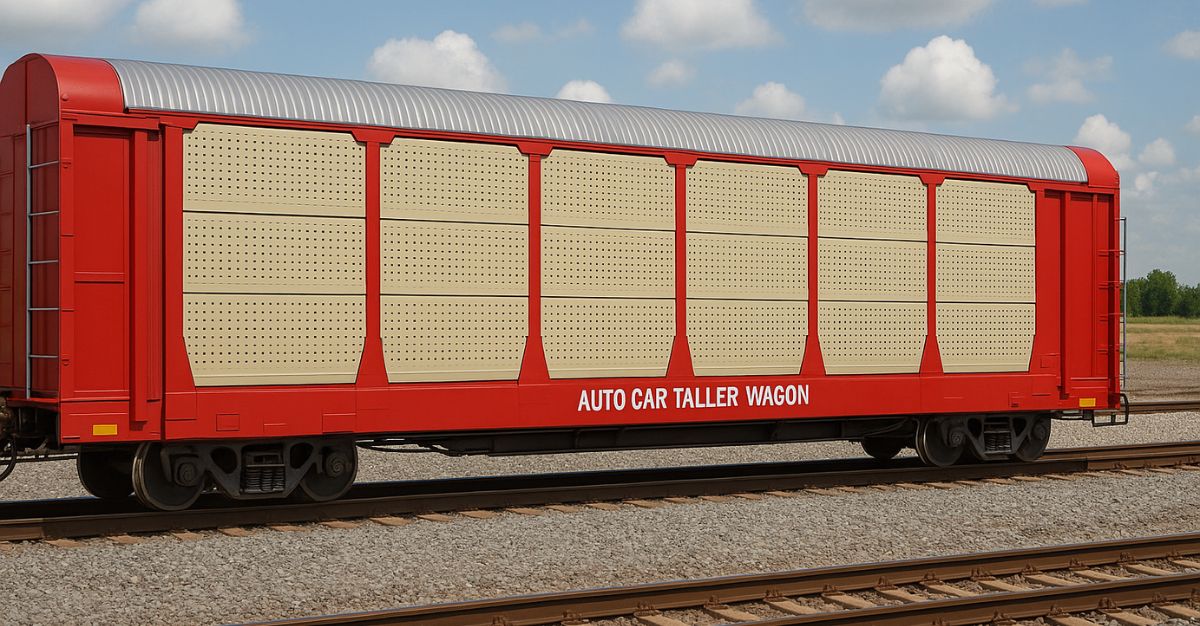

Texmaco Rail & Engineering Limited has bagged a domestic order valued at Rs 36,27,70,000 from the Transport Corporation of India Limited. This order is for two rakes, comprising 54 ACT-3 type wagons and two BVCMs, with a provision for an additional eight similar rakes contingent on performance and market conditions after the initial delivery. The ACT-3 Auto Car Taller Wagons are newly developed by Texmaco and designed to transport SUVs, small trucks and tractors. The contract, awarded by a domestic entity, is for the purchase of these two rakes and is expected to be executed within 24 months.

Earlier, the company received a domestic order from South Western Railway, valued at Rs 27,75,63,686. This contract, to be completed within 24 months from the Letter of Acceptance, encompasses comprehensive TRD (Traction Distribution) maintenance and breakdown activities across several key sections, including BYPL(Incl)-OML(Excl), YNK(Excl)-BWT(Excl), BAW (Incl)-SPGR (Incl), SBC (Incl)-JTJ (Excl), BAW (Excl) - HAS (Excl), BID-Y and YNK-DMM. The order underscores Texmaco Rail & Engineering Limited's expertise in critical railway infrastructure maintenance.

DSIJ’s 'multibagger Pick’ service recommends well researched multibagger stocks with High Returns potential. If this interests you, do download the service details here.

About the Company

Texmaco Rail & Engineering Limited, a listed Adventz Group company headquartered in Kolkata, is a vital player in the railway and infrastructure sector. With seven manufacturing facilities across India, Texmaco specialises in rolling stock, loco components, hydro-mechanical equipment, rail infrastructure, bridges and steel structures. The company manufactures freight cars for Indian Railways, private clients and export markets and its strategic joint ventures with global leaders like Wabtec and Touax expand its market reach. Texmaco's significant export activities further contribute to the 'Atmanirbhar Bharat' initiative, strengthening India's global standing in railway manufacturing.

According to Quarterly Results, the net sales increased by 18 per cent to Rs 1,346 crore in Q4FY25 compared to net sales of Rs 1,145 crore in Q4FY24. The company reported net profit of Rs 39 crore in Q4FY25. In its annual results, net sales increased by 46 per cent to Rs 5,107 crore and net profit skyrocketed 120 per cent to Rs 249 crore in FY25 compared to FY24. According to the shareholding pattern, the promoters of the company hold 48.27 per cent, FIIs hold 8.14 per cent, DIIs hold 7.91 per cent and the pubic holds the rest of the stake, i.e., 35.68 per cent.

The company has a market cap of over Rs 6,800 crore and as of June 03, 2025, the company’s order book stands at Rs 7,237 crore. The stock gave multibagger returns of 300 per cent in 3 years and a whopping 560 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.