Rs 9,967 Crore Order Book: Telecom infra company diversifies its optical fiber cable product portfolio as a part of business expansion!

DSIJ Intelligence-1 / 12 Jul 2025 / Categories: Multibaggers, Trending

The stock is up by 16 per cent from its 52-week low of Rs 71.50 per share and has given multibagger returns of over 500 per cent in 5 years.

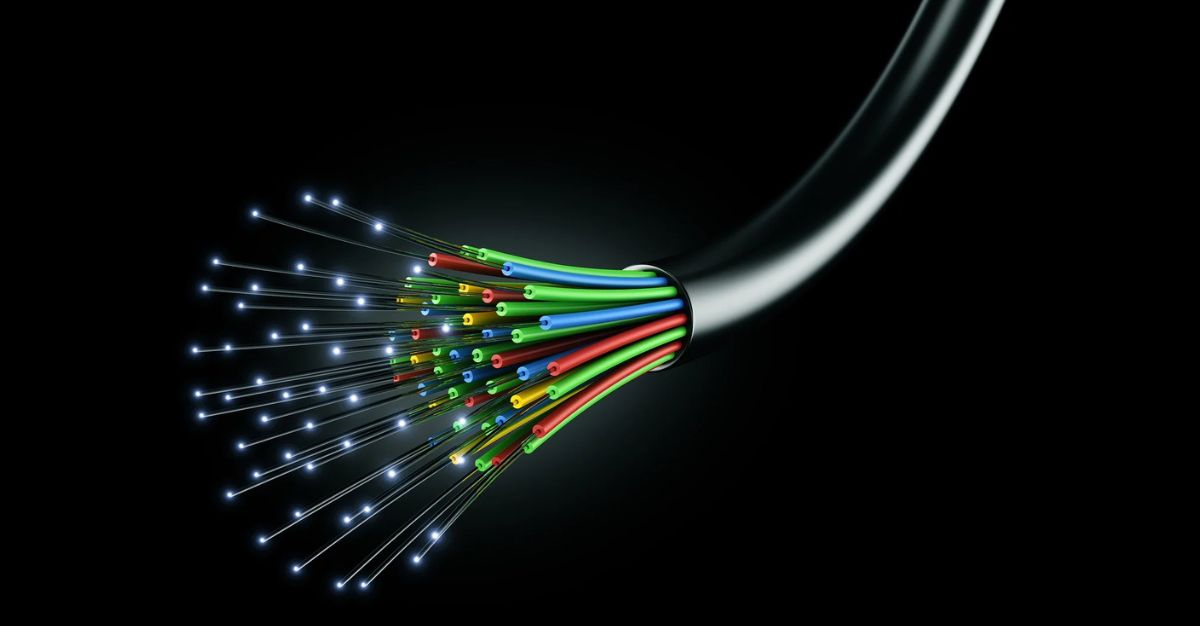

HFCL Limited's Board of Directors approved a significant expansion of its Intermittent Bonded Ribbon (IBR) cable manufacturing capacity. This strategic move will increase production from approximately 1.73 million fiber kilometres per annum (mfkm/p.a.) to about 19.01 mfkm/p.a. at its Hyderabad and Goa facilities, with a total capital outlay of approximately Rs 125.55 crore. The expansion aims to diversify the company's optical fiber cable portfolio, target high-value market segments, and capitalise on the growing global demand for IBR cables, particularly from North America and Europe, supported by existing orders from large hyperscalers.

IBR cables are crucial for high-density fiber deployments due to their superior performance, enhanced flexibility, splicing efficiency, and reduced weight, making them ideal for data centres and telecom networks. The capacity addition is expected to be completed in phases, starting from December 2025 and becoming fully operational by June 2026, financed through a combination of debts and internal accruals. Upon completion, HFCL's consolidated Optical Fiber Cable (OFC) manufacturing capacity will reach approximately 42.36 mfkm/p.a.

However, a previously announced expansion of the Optical Fiber Cable manufacturing facility by 10 mfkm/p.a, intended to be undertaken through its wholly-owned subsidiary, HFCL Technologies Private Limited (HTPL), has been temporarily put on hold. This suspension is attributed to the prevailing trans-border security situation and associated operational risks in Jammu & Kashmir, and the expansion will remain suspended until the regional situation stabilises and a conducive environment for industrial development is restored.

DSIJ’s 'multibagger Pick’ service recommends well researched multibagger stocks with High Returns potential. If this interests you, do download the service details here.

About the Company

HFCL is a leading technology provider specialising in building digital networks for telecom operators, businesses, and governments. With a strong foundation in fibre optics and decades of experience, HFCL offers sustainable, high-tech solutions, including 5G RAN and transport, Wi-Fi systems, and defence electronics. Its robust R&D centres in India and abroad continuously innovate cutting-edge products. Manufacturing facilities across India produce high-quality optical fibre, cables and telecom equipment, aligning with government initiatives like the PLI scheme. HFCL is a trusted partner for customers worldwide, committed to quality, sustainability, and meeting evolving network demands.

Order Book Update: As of March 2025, the company’s order book stands at Rs 9,967 crore. Out of the total order book, Government orders are worth Rs 8,414 crore and private company orders are worth Rs 1,553 crore.

The company has a market cap of over Rs 11,000 crore. The stock is up by 16 per cent from its 52-week low of Rs 71.50 per share and has given multibagger returns of over 500 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.