Simple Investing

Kiran Dhawale / 27 Sep 2018/ Categories: DSIJ_Magazine_Web, DSIJMagazine_App, Goal Planning, MF - Goal Planning

Age old wisdom suggests that real investing is boring and it’s very simple. However, in reality, what is simple and boring has turned out to be tedious and difficult for most investors to follow. Owing to the lack of financial education, retail investors end up basing their money decisions based on what are the options available and which of it is convenient to carry out, without much thought.

Mistakes to avoid while investing

Age old wisdom suggests that real investing is boring and it’s very simple. However, in reality, what is simple and boring has turned out to be tedious and difficult for most investors to follow. Owing to the lack of financial education, retail investors end up basing their money decisions based on what are the options available and which of it is convenient to carry out, without much thought. Over the years, we have come across several portfolios which investors have put together without a second thought. Of these, given below are most frequent types that one should be aware of. The aim here is to educate the readers of the most often made mistakes in the investing journey and what one can do to correct it.

Rohit Shah

CFP CM - Founder of Getting you Rich

1. Poorly designed & balanced

Asset allocation considerations should be the core of your portfolio construction. The basic definition demands that a portfolio should consist of

When designing the portfolio, be mindful that within mutual fund investments (for equity exposure) investments should be spread across various categories of funds which have varying mandates, risks, and return potential. Very often investors aggressively invest in a certain type of funds with an aim to maximise return, say mid cap or small cap funds. But what is forgotten is that such portfolios tend to be very volatile, thereby creating uncertainty in one’s financial journey

2. All over the place portfolio

For

It like this, when one visits a restaurant, do you end up ordering all the items on

3. Comparing apples with oranges

Many investors get confused between absolute and CAGR returns. The missing factor when most of the investors compare returns is the time value of money. It can be an apple to apple comparison between say a liquid mutual fund v/s FD, if only you take into consideration the time value factor.

For investors who are new to mutual fund investments, learning to read and understand the returns profile of a fund is very important. This is because the return figures may not match with one’s mental calculations figure, thereby leading to a panicky situation. One can overcome this situation by using portfolio trackers, which are freely available online. Such platforms will help you keep track of your investments on a regular basis and show the returns in a meaningful manner.

4. Not being consistent

Being consistent with your investment is one of the easiest ways to fight volatility when it comes to

5. Very profitable but minuscule

There are cases where investors have generated outsized returns by staying inactive for many years in mutual funds. This is

6. My money life is complicated

Anything that does not add value

7. Noise-based actions

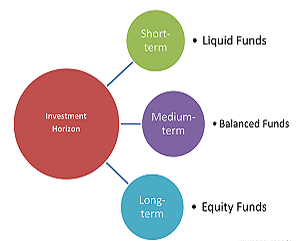

When it comes to investments, there is plenty of ‘short-term’ thinking going on. If you follow goal based investing principles and if the portfolio is designed correctly under the risk management framework, then

To sum up, investing can be very powerful if simple and well-thought steps are taken and followed to its logical end. Refrain from emotional investing as it will only hamper your hard earned money’s growth potential. With this we hope, you dear readers, will not repeat any of the