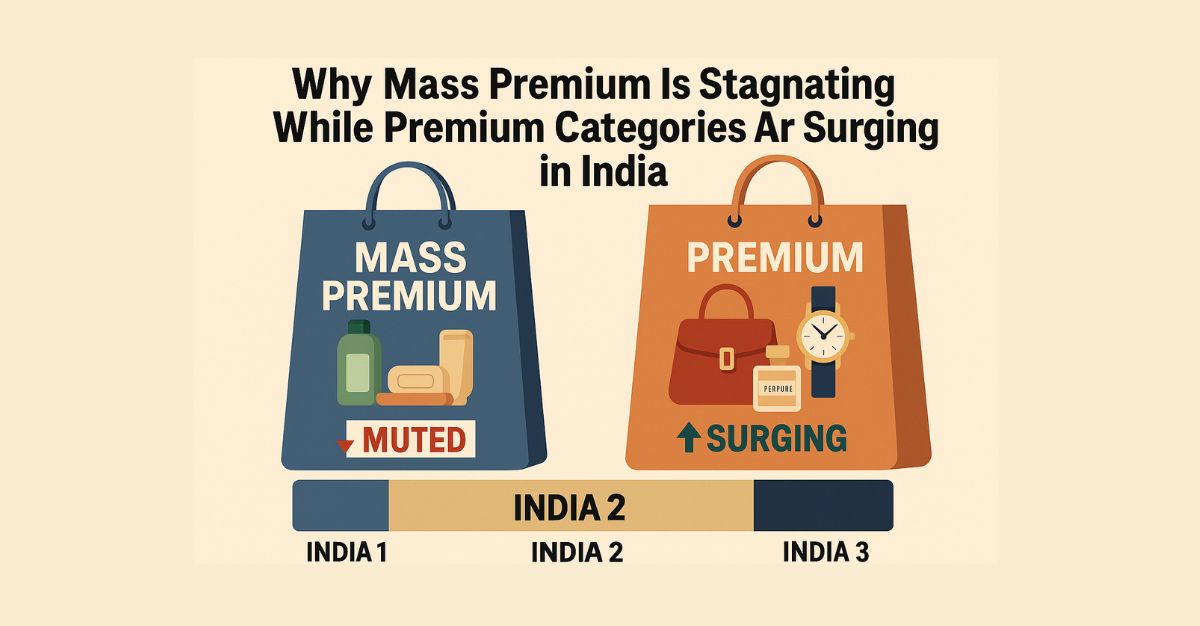

Why Mass Premium Is Stagnating While Premium Categories Are Surging in India

DSIJ Intelligence-7 / 21 Nov 2025 / Categories: General, Knowledge, Trending

How Income Polarisation, Credit Culture and Aspirational Behaviour Are Redefining India’s Consumption Story

India's consumption landscape is undergoing a structural transformation that goes far beyond temporary market trends or post-pandemic distortions. Over the past several years, a clear divergence has emerged: mass and mass-premium categories have struggled to generate meaningful volume growth, while premium segments across FMCG, automobiles, lifestyle, electronics and luxury have recorded consistent expansion. This shift is not accidental — it reflects changes in income distribution, behavioural finance patterns and a redefinition of aspiration among Indian consumers.

To understand this transformation, analysts increasingly refer to the “Three Indias” framework. India 1 represents the affluent and upper middle class with strong purchasing power, located largely in metros and Tier-I cities. India 2 consists of the aspirational middle class with rising income but limited financial cushion. India 3 represents the lower-income population that remains highly sensitive to inflation, food prices and wage stability. Over the last decade, the majority of income and wealth creation has occurred in India 1 and certain segments of India 2, while India 3 has experienced stagnant real income growth. This disparity explains why premium demand continues to rise while mass categories struggle for momentum.

Muted Growth in Mass-Premium Categories

Mass-premium segments — products positioned just above basic mass offerings — are facing a demand slowdown. These include entry-level personal care products, basic packaged food variants, low-ticket fashion and mid-range household goods. While historically these categories were growth drivers, rising cost pressures and inflation have eroded purchasing power among price-sensitive consumers.

Rural demand slowdown, shrinking discretionary surplus and trade-down behaviour have impacted companies focused on mass volumes. FMCG majors have increasingly acknowledged that premium portfolios are driving topline growth, while rural and mass markets remain under pressure. Consumers in India 3 prioritise essentials, reducing frequency-based discretionary spend. This explains muted growth in soaps, shampoos, affordable skincare and low-end packaged food, even as organised retail continues to expand.

Premium FMCG: Strong Brand Pull and Pricing Power

On the other hand, premium FMCG categories have shown remarkable growth. Organic foods, premium skincare, dermatology-backed coSMEtics, imported chocolates, luxury grooming products and high-end health supplements are witnessing accelerated adoption. Urban consumers increasingly associate quality with brand identity and emotional value.

Brands such as Forest Essentials, Kama Ayurveda, Nykaa Luxe, and premium segments from Hindustan Unilever and ITC are benefiting from this premiumisation trend. Higher value realisation and brand loyalty provide superior margins and sustainable brand equity. Premium consumption is not driven by necessity but by lifestyle aspiration and identity expression.

Automobiles: The clearest Evidence of Polarisation

The automobile sector provides one of the most visible illustrations of this shift. Entry-level hatchbacks and budget models have seen stagnation or decline, while vehicles priced above Rs 10 lakh continue to register strong growth. Mahindra’s SUV portfolio, heavily concentrated in the premium bracket, continues to see robust demand and long waiting periods.

Luxury auto brands such as Mercedes-Benz, BMW and Audi have achieved record sales volumes over consecutive years. The rising number of high-income buyers, combined with easier financing, has made premium vehicle ownership more accessible than ever before. This trend demonstrates that consumption growth is increasingly driven by value, not volume.

Lifestyle and Luxury: The Rise of Aspirational Consumption

India is witnessing an expansion of luxury consumption across watches, perfumes, designer clothing, footwear and accessories. Brands such as Rolex, Omega, Armani, Louis Vuitton, Hugo Boss and premium Indian designers have significantly expanded their footprint. Mall culture and high-end retail spaces are evolving into lifestyle destinations, while online luxury retail has democratised access for aspirational buyers.

The younger generation is placing greater value on brand image, experience and lifestyle upgrades. This shift is structural and long-term, influenced by global exposure, social media culture and aspirational aspirations.

Credit-Led Consumption: The Hidden Driver

A critical driver behind premiumisation is the explosion of consumer credit. Around 70% of iPhone purchases in India are now financed through EMI schemes, highlighting the growing preference for installment-based consumption. Credit cards, Buy Now Pay Later platforms and zero-cost EMI models have transformed the affordability equation.

India 2 consumers increasingly stretch budgets to finance premium products over time rather than saving first. This behavioural shift has led to declining savings rates among individuals aged below 35-40, signalling a structural shift from savings-led to credit-led consumption. This explains why premium demand continues even as income growth remains uneven.

Why This Structural Shift Is Unfolding

Several forces converge behind this transformation. Income concentration at the top, expanding urbanisation, digital formalisation, rising global influence and changing social identity have all reshaped consumer behaviour. Products today represent self-expression as much as functionality.

Mass brands struggle because their core customer segments face income pressure, while premium brands flourish because upper-income consumers prioritise lifestyle-enhancing purchases over basic utility.

Investor Perspective

For investors, this shift provides a blueprint for future allocation. Companies focused on premiumisation, pricing power, strong brand equity and aspirational positioning are structurally better placed than volume-only mass models. Businesses adaptable to changing consumption habits with premium-centric portfolios enjoy superior margin resilience and valuation multiples.

Key sectors benefiting include discretionary retail, premium FMCG, luxury auto, branded apparel and electronics. Companies failing to transition toward premiumisation risk long-term stagnation despite scale advantages.

Future Implication

India’s consumption economy is transitioning from being volume-centric to value-centric. While mass segments remain essential for socio-economic stability, premium categories represent the engine of future growth. This premium wave reflects deeper societal change driven by aspiration, lifestyle ambition and identity-based consumption.

Conclusion

The divergence between mass-premium stagnation and premium growth is a direct reflection of economic and behavioural evolution. Income inequality, access to credit, urban aspiration and global influence have redefined how India spends. For companies and investors, understanding this dynamic is essential for aligning strategy with the true vectors of growth. India is not consuming less — it is consuming smarter, selectively and aspirationally.

Disclaimer: The article is for informational purposes only and not investment advice.