Rs 3,346.35 crore order book: Railway Kavach company receives order worth Rs 209,82,00,000 from DFCCIL

DSIJ Intelligence-1 / 29 Aug 2025 / Categories: Multibaggers, Trending

The stock is up by 66 per cent from its 52-week low of Rs 625.55 per share and has given multibagger returns of 4,880 per cent in 5 years.

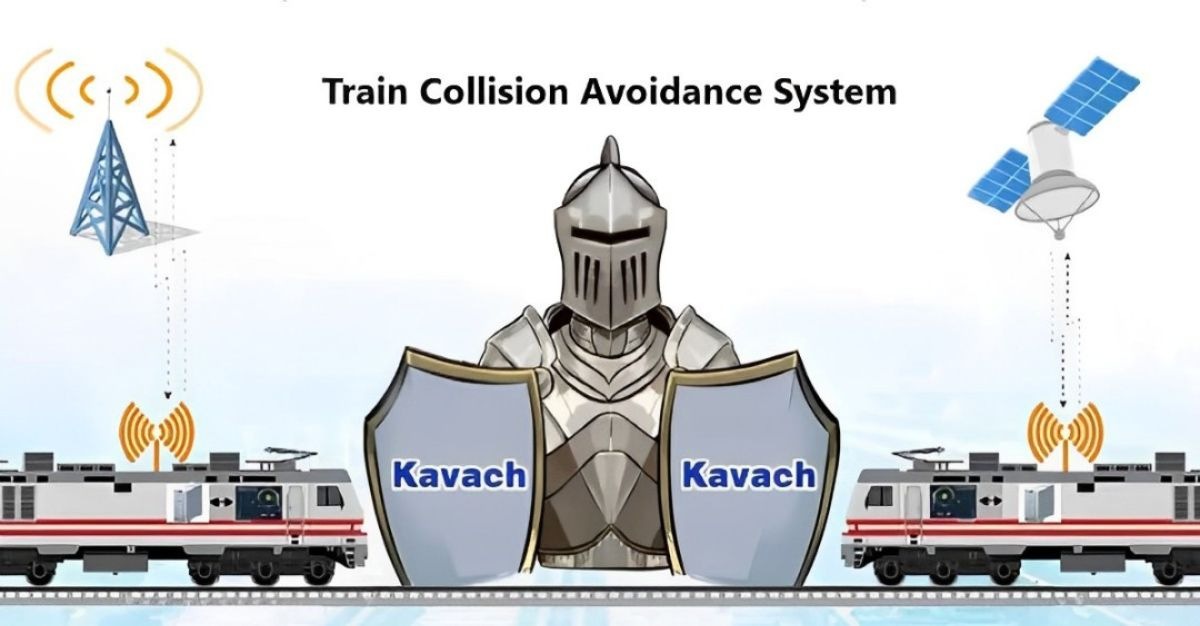

Kernex Microsystems (India) Limited has been awarded a contract by the Dedicated Freight Corridor Corporation of India Limited (DFCCIL) for the implementation of the KAVACH (Train Collision Avoidance System). The project, valued at Rs 209.82 crore (including GST), covers approximately 931 km of the Eastern Dedicated Freight Corridor and includes the survey, design, supply, installation, testing, and commissioning of the system, along with associated works. The project is expected to be completed within 730 days from the date the Letter of Acceptance (LoA) was issued.

Earlier, the company, through the KERNEX-KEC Consortium, was awarded a contract by the West Central Railways for the provision of the KAVACH (indigenous Automatic Train Protection system) on the Itarsi-Khandwa and Bina-Ruthiyai sections of the Bhopal Division. The project has a bid cost of Rs 151.41 crore (including GST) and is set to be completed in 600 days. This domestic contract includes the installation of the system on a UHF backbone with OFC and route diversity.

About the Company

Kernex Microsystems (India) Ltd, established in 1991, is a leading provider of safety systems and software services for the railway industry. The company, an ISO 9001:2015 certified export-oriented unit, specialises in delivering turnkey electronic systems and technical support. Their product and service offerings encompass a wide range of solutions, including anti-collision devices, train collision avoidance systems, automatic level crossing gates, signalling systems, headway improvement technologies, and water management solutions. Kernex Microsystems leverages its expertise in wireless front-end, satellite communication, embedded systems, signal processing, network management, and software development to provide innovative and reliable solutions to the railway industry.

DSIJ’s 'Tiny Treasure' service recommends researched Small-Cap stocks with Inherent Growth Potential. If this interests you, download the service details here.

In its Quarterly Results, the net sales increased by 95 per cent to Rs 55.93 crore and net profit increased by 108 per cent to Rs 7.41 crore in Q4FY25 compared to Q4FY24. In its annual results, the net sales increased by 850 per cent to Rs 190 crore in FY25 compared to FY24. The company reported a turnaround net profit of Rs 50 crore in FY25 compared to a net loss of Rs 27 crore in FY24, an increase of 285 per cent.

The company has a market cap of over Rs 1,700 crore and its order book as of August 29, 2025, stands at Rs 3,349.95 crore. According to the shareholding of the company, the promoters own 28.97 per cent stake, FIIs own 0.52 per cent stake, DIIs own 1.11 per cent stake, the Government own 0.06 per cent stake and the rest of the stake is owned by the public i.e., 69.34 per cent. The stock is up by 66 per cent from its 52-week low of Rs 625.55 per share and has given multibagger returns of 4,880 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.