The fundamentals of diversification

Diversification is made out to be a panacea against the risk of volatility, be it volatility in prices of stocks on the stock markets or volatility in interest rates in debt market. But diversification is a broad concept that needs to be understood thoroughly by the investors. So let’s try to understand what is meant by diversification.

✨ AI Powered Summary

Diversification is made out to be a panacea against the risk of volatility, be it volatility in prices of stocks on the stock markets or volatility in interest rates in debt market. But diversification is a broad concept that needs to be understood thoroughly by the investors. So let’s try to understand what is meant by diversification.

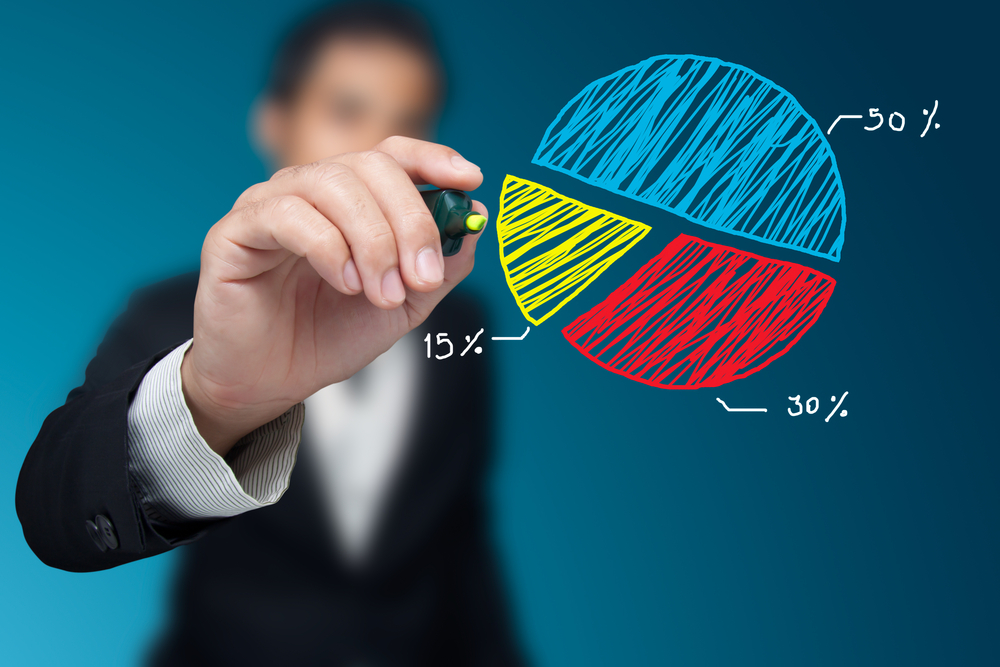

For an equity and equity-fund investor, diversification would mean investing in companies from diverse sectors and industries such as banking, IT, FMCG, power, steel, engineering, auto, cement, among others, as well as companies with different market capitalisations, viz. small-cap, mid-cap and large-cap. Such diversification across sectors, industries and market caps

An investor who chooses to diversify across different asset classes would reap the benefits of broad-based diversification. An investor might invest in various asset classes such as equities, gold. debt, real estate, etc. All these assets have different levels of risks attached to them, where equities carry the highest risk while real estate may carry the lowest risk. The prices of equities and gold fluctuate on a daily basis, while the prices of real estate may vary on a quarterly, half-yearly or annual basis, depending on the demand-supply scenario of residential and commercial properties in the locality, area and city. The movement in prices of bonds will depend on the movement of interest rates, which in turn depend on various macroeconomic factors. As interest rates do not move up or down on a day-to-day basis, the risk associated with debt investments is comparatively low. Therefore, an investment portfolio comprising of equities, debt, gold and real estate is widely diversified and provides

The different kind of mutual fund schemes available in the market

Hence, depending on the risk appetite, return expectations and financial goals to be achieved, investors can pick and choose between various asset classes to build a well-diversified portfolio of investments.