Auri Grow India Ltd Board accepts the proposal of Hong Kong-based FII, Luminary Crown Ltd, for acquiring 24% stake

DSIJ Intelligence-1Categories: Penny Stocks, Trending

The company has a market cap of over Rs 100 crore and the stock is up by 78 per cent from its 52-week low of Re 0.45 per share.

In a significant move for India’s agri-tech sector, Indore-based Auri Grow India Ltd (NSE: AURIGROW) has granted in-principle approval to a proposal from Hong Kong-based Foreign Institutional Investor (FII), Luminary Crown Ltd. The investor seeks to acquire up to a 24 per cent equity stake at an indicative price of Rs 2 per share-a substantial premium over the current market price of Rs. 0.80. The Board has authorized management to evaluate various investment routes, including preferential allotments or rights issues, while maintaining a firm stance that the FII will receive no board seats or special governance rights.

The proposed collaboration aims to leverage Auri Grow’s recent financial momentum, which saw revenue surge tenfold to Rs 175.55 crore in FY24-25. Luminary Crown intends to drive strategic expansion into rice aggregation, processing, and exports, specifically targeting the GCC and European markets. This export-oriented initiative is designed to scale the company’s footprint by utilising India’s robust agricultural supply chain and the investor’s international reach.

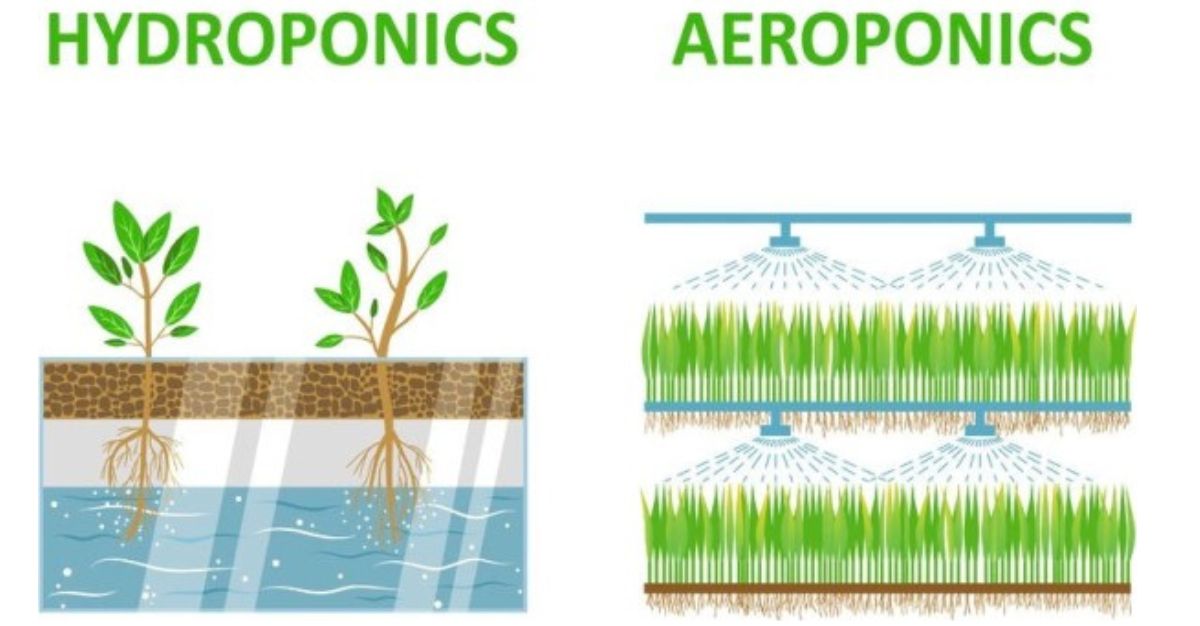

A major highlight of the Letter of Intent is the development of a hydroponics and aeroponics farming project with an estimated cost of Rs 55 crore. This technology-driven venture is projected to generate annual revenues between Rs. 180–200 crore with a net margin of approximately 13 per cent. By integrating these advanced farming methods, the company aims to enhance productivity and position itself within premium, high-margin agricultural segments.

Additionally, the partnership explores the establishment of organic farming operations on Auri Grow’s existing land Bank for a minimum of five years. While the proposal signals a transformative shift for the company, the Board emphasised that these discussions are currently exploratory and non-binding. Any definitive agreement remains subject to further evaluation, regulatory clearances, and shareholder approval to ensure the long-term interests of the company are protected.

About the Company

Based in Indore, Auri Grow India Ltd (formerly Godha Cabcon & Insulation Ltd) is a specialised manufacturer of electrical conductors and cables, including ACSR, AAAC, and AAC for power transmission and distribution. Since its incorporation in 2016, the company has evolved from a family-led manufacturing setup into a diversified entity, expanding its operations into agri-tech and exports alongside its core power sector business. Having recently achieved a significant financial turnaround from losses to profitability, the firm is attracting increased interest from foreign investors as it scales its production of both overhead lines and underground cabling solutions.

The stock’s 52-week high is Rs 1.36 per share and its 52-week low is Re 0.46 per share. The shares of the company have a single-digit PE of 18x whereas the industry PE is 33x. The companyhas a market cap of over Rs 100 crore and the stock is up by 78 per cent from its 52-week low of Re 0.45 per share.

Disclaimer: The article is for informational purposes only and not investment advice.