રોડ કન્સ્ટ્રક્શન કંપનીને એનએચએઆઈ તરફથી રૂ. 86,70,77,575 નું કામનું ઓર્ડર મળ્યું.

સ્ટોક તેના 52-અઠવાડિયાના નીચા સ્તર રૂ. 95 પ્રતિ શેર કરતાં 26.3 ટકા વધ્યું છે.

✨ AI Powered Summary

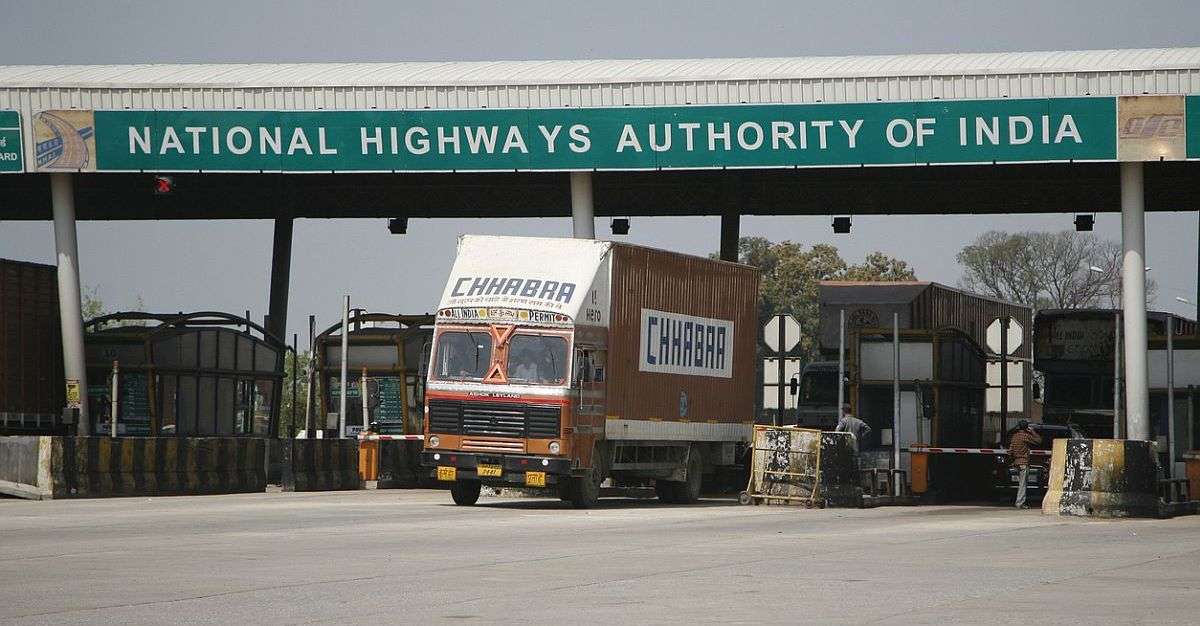

બી.આર. ગોયલ ઇન્ફ્રાસ્ટ્રક્ચર લિમિટેડ (BRGIL)એ નેશનલ હાઇવે ઓથોરિટી ઓફ ઇન્ડિયા (NHAI) તરફથી મહત્વપૂર્ણ સ્થાનિક કાર્ય ઓર્ડર સફળતાપૂર્વક પ્રાપ્ત કર્યો છે. સ્પર્ધાત્મક ઇ-ટેન્ડરિંગ પ્રક્રિયા દ્વારા આપવામાં આવેલ આ કરાર BRGILને રાજસ્થાનમાં NH-76 પરના બે મુખ્ય સ્થળોએ, સિમલિયા ફી પ્લાઝા (કિમી 409.680) અને ફતેહપુર ફી પ્લાઝા (કિમી 461.290) માટે વપરાશકર્તા ફી કલેક્શન એજન્સી તરીકે નિયુક્ત કરે છે. આ પ્રોજેક્ટ હાઇવેના કોટા-બારાન વિભાગમાં ફેલાય છે અને તેની કુલ સ્વીકૃત કિંમત રૂ. 86,70,77,575 છે.

આ એક વર્ષની લેટર ઓફ એવોર્ડ (LOA)ની શરતો હેઠળ, કંપની વપરાશકર્તા ફીનું સુનિયંત્રિત સંગ્રહ તેમજ નજીકના ટોઇલેટ બ્લોક્સના આવશ્યક જાળવણી અને જાળવણી માટે જવાબદાર છે, જેમાં વપરાશની વસ્તુઓની ભરપાઇ પણ શામેલ છે. આ સ્થાનિક કરાર BRGILની ઇન્ફ્રાસ્ટ્રક્ચર ક્ષેત્રમાં, ખાસ કરીને હાઇવે ઓપરેશન્સ અને મેનેજમેન્ટમાં હાજરીને મજબૂત બનાવે છે. અમલનો સમયગાળો એક વર્ષ માટે નક્કી કરવામાં આવ્યો છે, જેના દરમિયાન કંપની કિમી 388.263 થી કિમી 492.322 સુધીના નિર્દિષ્ટ વિસ્તારોનું નિરીક્ષણ કરશે.

કંપની વિશે

બી.આર. ગોયલ ઇન્ફ્રાસ્ટ્રક્ચર લિમિટેડ (BRGIL), 2005 માં સ્થાપિત, એક સંકલિત EPC (ઇજનેરી, પ્રોક્યુરમેન્ટ, અને કન્સ્ટ્રક્શન) અને કન્સ્ટ્રક્શન કંપની છે જે અનેક ભારતીય રાજ્યોમાં હાજરી ધરાવે છે. ઇન-હાઉસ ડિઝાઇન અને ઇજનેરી ટીમ દ્વારા સપોર્ટેડ, કંપની વિવિધ ક્ષેત્રોમાં કાર્યરત છે, જેમાં રસ્તા, હાઇવે, પુલ અને ઇમારતોનું નિર્માણ શામેલ છે. BRGIL નેશનલ હાઇવે ઓથોરિટી ઓફ ઇન્ડિયા (NHAI) માટે 12 ટોલ કલેક્શન કરારો પણ સંચાલિત કરે છે અને તાજેતરમાં અંડરગ્રાઉન્ડ ગટરના સિસ્ટમો અને વેસ્ટવોટર ટ્રીટમેન્ટ પ્લાન્ટ્સના વિકાસમાં વિસ્તરણ કર્યું છે. વધુમાં, કંપની રિયલ એસ્ટેટ વિકાસમાં પણ સામેલ છે, જેમાં ઇન્દોરમાં રહેણાંક પ્લોટિંગ પ્રોજેક્ટ્સ લોન્ચ કરવામાં આવ્યા છે.

બી.આર. ગોયલ ઇન્ફ્રાસ્ટ્રક્ચર લિમિટેડનું માર્કેટ કેપિટલાઇઝેશન રૂ. 286 કરોડ છે. કંપનીનો પ્રાઇસ-અર્નિંગ્સ (PE) રેશિયો 9 છે, ROE 14 ટકા અને ROCE 18 ટકા છે. સ્ટોક તેના52-અઠવાડિયાના નીચા રૂ. 95 પ્રતિ શેરથી 26.3 ટકા વધ્યો છે.

અસ્વીકરણ: આ લેખ માત્ર માહિતી માટે છે અને રોકાણ સલાહ નથી.