Road construction company allots 12,80,000 equity shares consequent to the conversion of warrants!

DSIJ Intelligence-1Categories: Multibaggers, Penny Stocks, Trending

From Rs 0.30 to Rs 39.75 per share, the stock rocketed over 13,000 per cent in 5 years.

On Thursday, shares of Hazoor Multi Projects Ltd jumped 4.1 per cent to Rs 38.80 per share from its previous closing of Rs 37.28 per share. The stock’s 52-week high is Rs 59.59 per share and its 52-week low is Rs 26.80 per share.

Hazoor Multi Projects Limited's fund-raising committee, at its meeting on December 11, 2025, approved the preferential allotment of 12,80,000 equity shares of Re 1 each at an issue price of Rs 30 per share (including a Rs 29 premium), following the conversion of 1,28,000 warrants. This conversion, which comes after a stock sub-division from Rs 10 to Re 1 face value, was exercised by three non-promoter/public allottees, including Seabird Leasing and Finvest Private Limited, upon the Company's receipt of the balance payment of Rs 2,88,00,000. Consequent to this allotment, the Company’s issued and paid-up capital has increased to Rs 23,69,39,910, consisting of an equal number of Re 1 equity shares, with the new shares ranking pari-passu with existing shares.

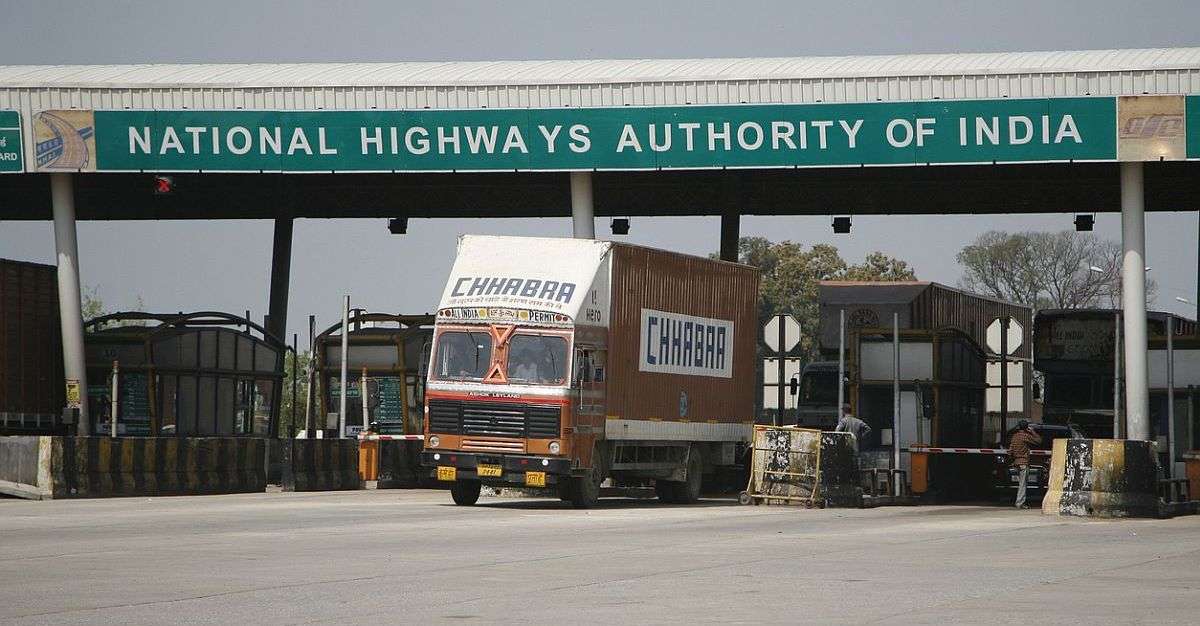

Earlier, the company had won two one-year domestic Letters of Award (LOA) from the NHAI, totalling Rs 277.40 crore, for collecting user fees and maintaining toilet blocks at two fee plazas, secured via competitive e-bidding. The larger contract, valued at Rs 235.43 crore, is for the Ankadhal Fee Plaza on the Sangli-Solapur section of NH-166 in Maharashtra, while the second, worth Rs 41.98 crore, is for the Krishnagiri Fee Plaza on the Hosur-Krishnagiri section of NH-44 in Tamil Nadu, demonstrating the company's success in key highway revenue collection and maintenance contracts.

About the Company

Hazoor Multi Projects Ltd. (HMPL) is a BSE-listed, diversified infrastructure and engineering company based in Mumbai, with core operations spanning highways, civil EPC works and shipyard services and now in the Oil and Gas Sector. Known for execution excellence and strategic clarity, HMPL has built a solid track record across capital-intensive, nationally significant projects. With a focus on scalable growth, recurring revenues and multi-vertical integration, HMPL is building a future-ready platform at the intersection of infrastructure, energy and industrial technology.

According to the Quarterly Results (Q2FY26), the company reported net sales of Rs 102.11 crore and a net loss of Rs 9.93 crore while in the half-yearly results (H1FY26), the company reported net sales of Rs 282.13 crore and a net profit of Rs 3.86 crore. Looking at its annual results (FY25), the company reported net sales of Rs 638 crore and a net profit of Rs 40 crore.

The company has a market cap of Rs 871 crore. In September 2025, FIIs bought 55,72,348 shares and increased their stake to 23.84 per cent compared to June 2025. From Rs 0.25 to Rs 38.80 per share, the stock rocketed over 15,000 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.