Rs 4,000+ Crore Order Book: Railway Kavach Company Receives Rs 800.36 Crore Order From Banaras Locomotive Works, Varanasi

Kiran DSIJCategories: Multibaggers, Trending

The stock gave multibagger returns of 685 per cent in 3 years and a whopping 2,200 per cent in 5 years.

On Wednesday, shares of HBL Engineering Limited (formerly known as HBL Power Systems Ltd) zoomed 4.91 per cent to Rs 817.25 per share from its previous closing of Rs 779 per share. The stock has a 52-week high of Rs 1,121.95 per share and its 52-week low is Rs 404.30 per share. The shares of the company saw a Spurt in Volume by more than 1.5 times on the BSE.

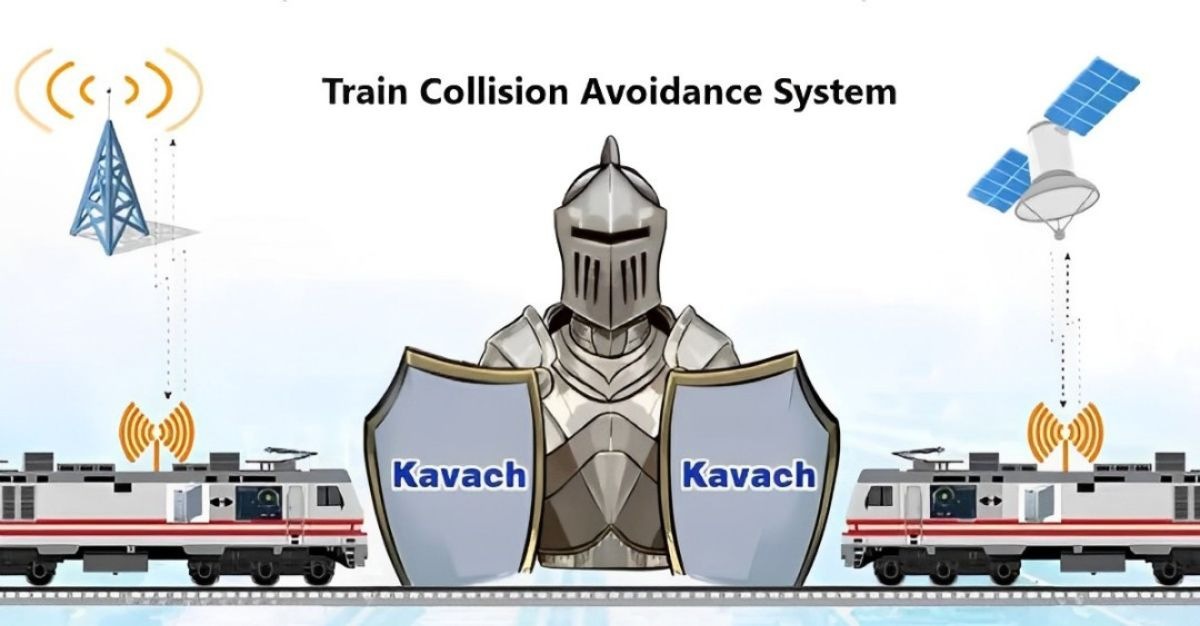

HBL Engineering Limited has secured a significant domestic contract from Banaras Locomotive Works (BLW), Varanasi, for the supply, testing, and commissioning of On-board KAVACH equipment (Version 4.0). This order, valued at Rs 800.36 crore (inclusive of 18% GST), marks a major milestone in the implementation of India's indigenous Automatic Train Protection (ATP) system. The project is slated for completion within a 12-month timeframe, emphasising a rapid rollout of safety technology designed to prevent collisions and assist loco pilots in demanding operational conditions.

About the Company

HBL Engineering Ltd., established in 1983, has cemented its position as a leading innovator in the power systems industry, achieving significant global market share, notably holding the second position in industrial nickel batteries and the third in India's VRLA lead batteries, while uniquely manufacturing PLT lead batteries in the nation. The company's diversified portfolio spans industrial batteries, powering sectors like telecom and oil and gas, with products utilised in Vande Bharat trains and by global entities such as Siemens and Hitachi. Further, their Defence and aviation segment provides critical power solutions for military applications, and the electronics division develops cutting-edge technologies like TCAS and TMS, alongside their push into electric mobility with drive trains for heavy-duty trucks, demonstrating a commitment to both technological advancement and sustainable solutions.

The company has a market cap of over Rs 22,000 crore and has delivered a good profit growth of 65 per cent CAGR over the last 5 years. The total accumulated Order Book is Rs 4,000+ crore. The stock gave multibagger returns of 685 per cent in 3 years and a whopping 2,200 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.