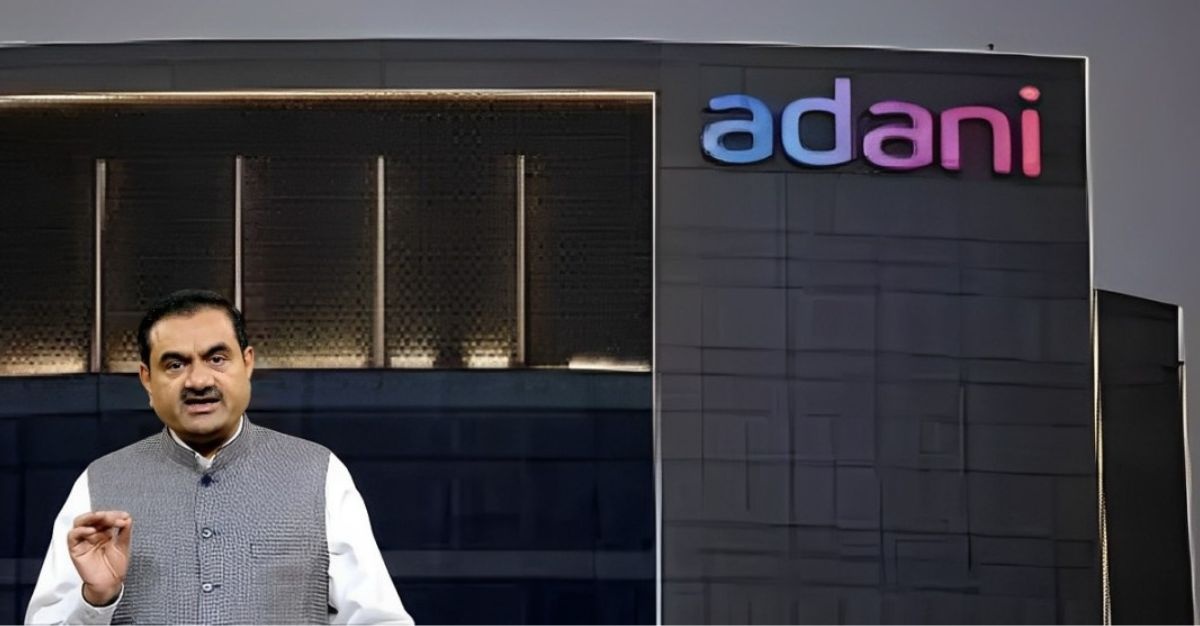

Gautam Adani-Backed Adani Enterprises Commits USD 100 Billion to Sovereign AI Infrastructure

Kiran DSIJCategories: Multibaggers, Trending

The stock is up by 22 per cent from its 52-week low of Rs 1,850 per share and has given multibagger returns of 5,200 per cent in 10 years.

The Adani Group has announced a massive USD 100 billion direct investment to develop a green-energy-powered AI infrastructure backbone for India by 2035. This initiative focuses on building hyperscale, AI-ready data centers integrated with renewable energy sources, aiming to expand the current AdaniConneX platform toward a 5 GW target. By linking massive power generation—such as the 30 GW Khavda project—directly with high-density compute clusters, the group intends to establish a self-sustaining "energy-compute" ecosystem that secures India's data sovereignty in the age of artificial intelligence.

This strategic roadmap is expected to catalyse an additional USD 150 billion in ecosystem investments, spanning server manufacturing, sovereign cloud services, and advanced electrical infrastructure. To support this growth, Adani is deepening partnerships with global tech leaders like Google and Microsoft, while also expanding its collaboration with Flipkart to develop specialised high-performance AI data centers. These hubs will utilise advanced liquid cooling and high-efficiency power architectures to manage the intensive workloads required by modern Large Language Models (LLMs) and deep-tech innovations.

Beyond hardware, the initiative prioritises national self-Reliance by co-investing in domestic manufacturing for critical components like high-capacity Transformers and thermal management systems. A significant portion of the newly created GPU capacity will be reserved for Indian startups and research institutions to democratize access to high-performance computing. To ensure long-term sustainability, the group is also launching talent initiatives and specialised AI engineering curricula to build the technical workforce necessary to maintain this $250 billion national AI infrastructure.

About Adani Enterprises Ltd

Adani Enterprises Limited (AEL) is the flagship company of Adani Group, one of India’s largest business organisations. Over the years, Adani Enterprises has focused on building emerging infrastructure businesses, contributing to nation-building and divesting them into separate listed entities. Having successfully built sizeable and scalable businesses like Adani Ports & SEZ, Adani Energy Solutions, Adani Power, Adani Green Energy, Adani Total Gas and Adani Wilmar, the company has contributed to making India self-reliant with our robust businesses. This has also led to significant returns to our shareholders for three decades. The next generation of its strategic business investments is centred around green hydrogen ecosystem, airport management, data centre, roads and primary industries like copper and Petrochem.

A strong performer with a market cap of Rs 2.50 lakh crore, the company has consistently delivered impressive profit growth of 36 per cent CAGR over the last 5 years. The stock is up by 22 per cent from its 52-week low of Rs 1,850 per share and has given multibagger returns of 5,200 per cent in 10 years.

Disclaimer: The article is for informational purposes only and not investment advice.