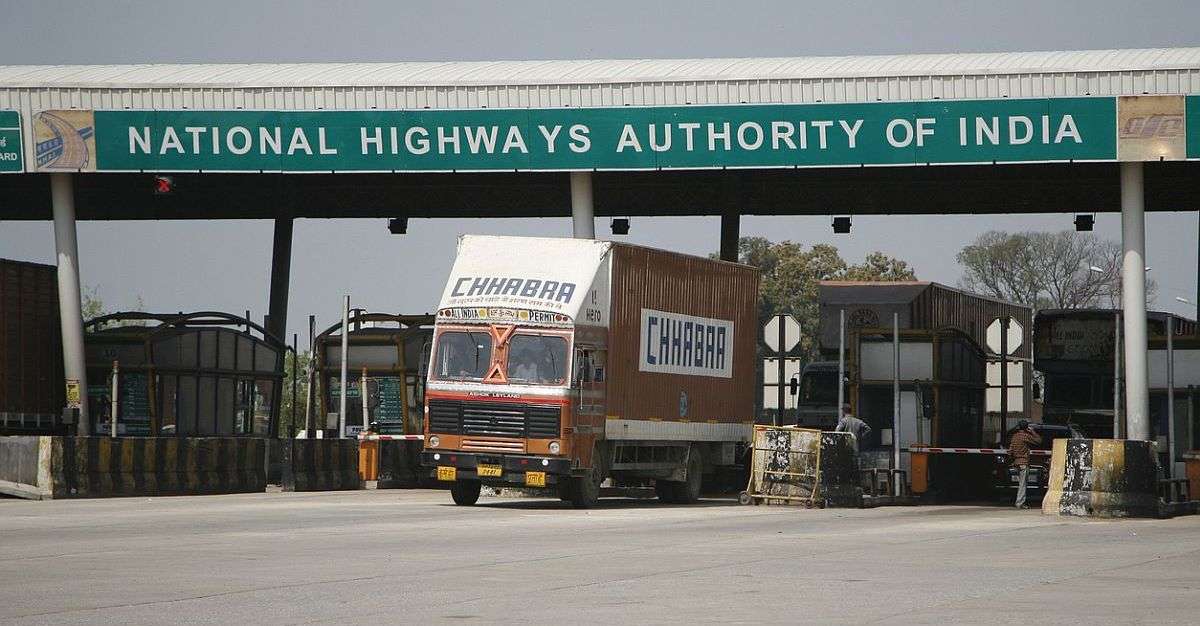

Road infrastructure company bags order worth Rs 44,23,80,000 from National Highways Authority of India

Kiran DSIJCategories: Multibaggers, Penny Stocks, Trending

From Rs 0.34 per share to Rs 35.59 per share, the stock rocketed over 10,000 per cent in 5 years.

Hazoor Multi Projects Limited has secured a significant domestic contract valued at Rs 44,23,80,000 from the National Highways Authority of India (NHAI) for user fee collection at the Balenahalli fee plaza in Karnataka. This one-year engagement covers the four-lane section of NH-150A between Challakere and Hiriyur, specifically from Design Km 358.500 to Km 414.205. Beyond toll collection, the scope of the Letter of Award includes the essential upkeep and maintenance of adjacent toilet blocks, ensuring the continuous replenishment of consumables. This competitive bid win underscores Hazoor's expanding operational role in managing critical infrastructure assets within India's national highway network.

About the Company

Hazoor Multi Projects Ltd. (HMPL) is a BSE-listed, diversified infrastructure and engineering company based in Mumbai, with core operations spanning highways, civil EPC works, and shipyard services. It is now in the Oil and Gas Sector. Known for execution excellence and strategic clarity, HMPL has built a solid track record across capital-intensive, nationally significant projects. With a focus on scalable growth, recurring revenues and multi-vertical integration, HMPL is building a future-ready platform at the intersection of infrastructure, energy and industrial technology.

According to the Quarterly Results (Q3FY26), the company reported net sales of Rs 75.97 crore and a net profit of Rs 2.72 crore. In its nine-month results (9MFY26), the company reported net sales of Rs 259.20 crore (an increase of 55 per cent YoY) and a net profit of Rs 12.43 crore (an increase of 57 per cent YoY). Looking at its annual results (FY25), the company reported net sales of Rs 638 crore and a net profit of Rs 40 crore. The company has a market cap of over Rs 800 crore. From Rs 0.34 per share to Rs 35.59 per share, the stock rocketed over 10,000 per cent in 5 years.

Disclaimer: The article is for informational purposes only and not investment advice.